Crypto PCA First Eigenvector

Crypto PCA First Eigenvector

This short blog to illustrate an interesting fact that I found in An Analysis of Eigenvectors of a Stock Market Cross-Correlation Matrix by Nguyen and co-authors: The first eigenvector is not THE market portfolio (market-cap or uniformly weighted) as people usually believe, but a correlation-weighted market portfolio.

import numpy as np

import pandas as pd

from scipy.stats import rankdata

import matplotlib.pyplot as plt

def get_returns():

"""Compute daily returns from prices."""

prices = pd.read_parquet('market_data/futures_prices.parquet')

rect_prices = (prices

.pivot(index='close_time',

columns='symbol',

values='close')

.astype(float))

return rect_prices.pct_change()

returns = get_returns()

xxx = returns.describe().T

coins = xxx[xxx['count'] > 500].index

returns = returns[coins].iloc[-500:]

returns.shape

(500, 101)

corr = returns.corr()

tri_a, tri_b = np.triu_indices(len(corr), k=1)

flat_corr = corr.values[tri_a, tri_b]

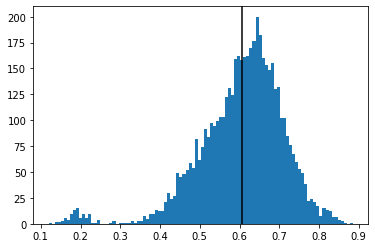

plt.hist(flat_corr, bins=100)

plt.axvline(flat_corr.mean(), color='k')

plt.show()

The average correlation between cryptos is quite high: 60%.

Let’s get the first eigenvector, and look into it:

eigenvals, eigenvecs = np.linalg.eig(corr)

idx = eigenvals.argsort()[::-1]

pca_eigenvecs = eigenvecs[:, idx]

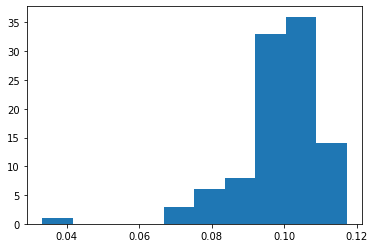

Distribution of the first eigenvector coefficients:

plt.hist(pca_eigenvecs[:, 0])

plt.show()

All positive.

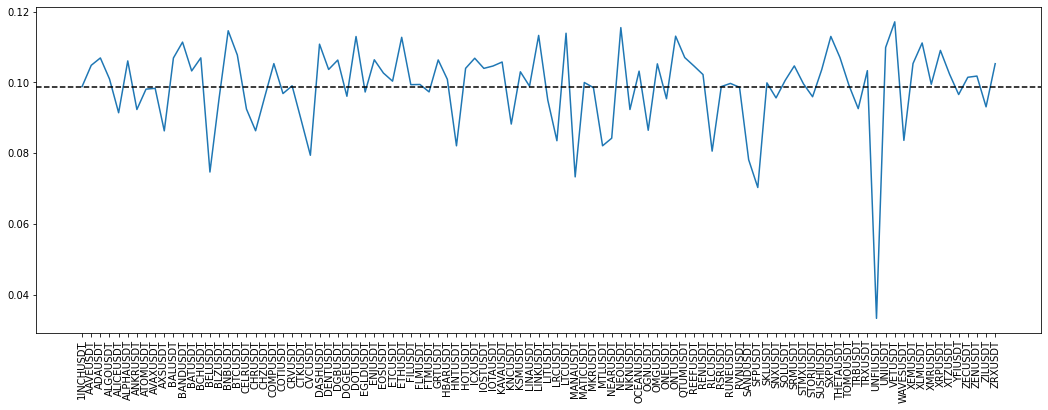

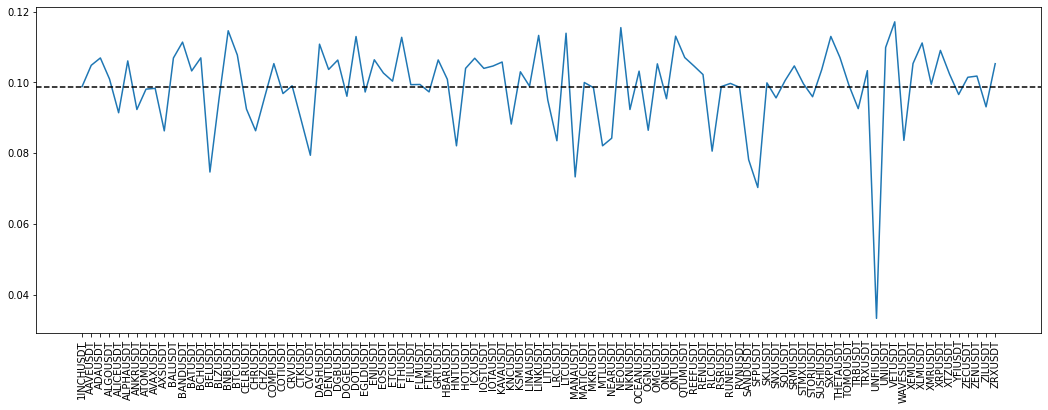

The first eigenvector:

plt.figure(figsize=(18, 6))

plt.plot(pca_eigenvecs[:, 0])

plt.axhline(np.mean(pca_eigenvecs[:, 0]), color='k', linestyle='--')

plt.xticks(range(len(returns.columns)), returns.columns, rotation=90)

plt.show()

It is a widespread belief that coefficients should be roughly uniformly distributed.

Let’s define the ‘correlation weights’ as $w_i = \sum_{j=1}^n \rho_{ij}$.

corr_weight = corr.sum(axis=1)

corr_weight.sort_values()

symbol

UNFIUSDT 21.495413

SFPUSDT 43.984479

MANAUSDT 45.965002

BELUSDT 46.941996

SANDUSDT 49.003187

...

LINKUSDT 70.467031

LTCUSDT 70.753819

BNBUSDT 71.275130

NEOUSDT 71.753468

VETUSDT 72.800973

Length: 101, dtype: float64

VET is the most correlated with the rest of the coins; UNFI the least.

normalized_weights = sum(pca_eigenvecs[:, 0]) * corr_weight / corr_weight.sum()

normalized_weights.sum(), sum(pca_eigenvecs[:, 0])

(9.980197180593267, 9.980197180593267)

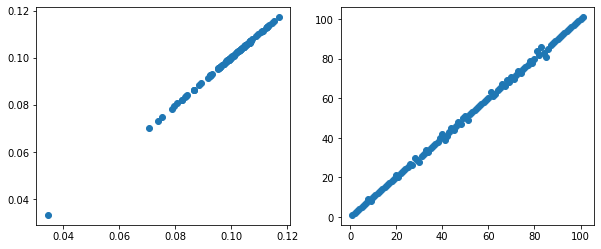

plt.figure(figsize=(10, 4))

plt.subplot(1, 2, 1)

plt.scatter(normalized_weights, pca_eigenvecs[:, 0])

plt.subplot(1, 2, 2)

plt.scatter(rankdata(normalized_weights),

rankdata(pca_eigenvecs[:, 0]));

plt.show()

On the above graphs, we can clearly see that the first eigenvector gives the same weights as the ‘correlation weights’ which are basically proportional to how much an asset (here a crypto) is correlated to the rest of the assets (cryptos) of the universe. The higher the correlation with the rest of the coins, the higher the weight.

In the paper An Analysis of Eigenvectors of a Stock Market Cross-Correlation Matrix, this observation is presented as an empirical fact verified on the Vietnamese stock market. In this blog, we have verified that this fact holds for cryptocurrencies as well. However, given its regularity and the intuitive relationship between average correlation and total variance, I am not sure this is purely an empirical fact: It may be possible to prove it.