Study of US Stocks Correlations, Hierarchies and Clusters

In this small study, we use hierarchical clustering techniques to explore the structure of correlations between US stocks. To do so, we first download a dataset of adjusted close prices for the US stocks from Quandl.

import numpy as np

import pandas as pd

from datetime import datetime

import matplotlib.pyplot as plt

%matplotlib inline

df = pd.read_csv('data/WIKI_PRICES.csv')

df.head()

| ticker | date | open | high | low | close | volume | ex-dividend | split_ratio | adj_open | adj_high | adj_low | adj_close | adj_volume | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | A | 1999-11-18 | 45.50 | 50.00 | 40.00 | 44.00 | 44739900 | 0 | 1 | 31.105117 | 34.181447 | 27.345157 | 30.079673 | 44739900 |

| 1 | A | 1999-11-19 | 42.94 | 43.00 | 39.81 | 40.38 | 10897100 | 0 | 1 | 29.355027 | 29.396044 | 27.215268 | 27.604936 | 10897100 |

| 2 | A | 1999-11-22 | 41.31 | 44.00 | 40.06 | 44.00 | 4705200 | 0 | 1 | 28.240711 | 30.079673 | 27.386175 | 30.079673 | 4705200 |

| 3 | A | 1999-11-23 | 42.50 | 43.63 | 40.25 | 40.25 | 4274400 | 0 | 1 | 29.054230 | 29.826730 | 27.516065 | 27.516065 | 4274400 |

| 4 | A | 1999-11-24 | 40.13 | 41.94 | 40.00 | 41.06 | 3464400 | 0 | 1 | 27.434029 | 28.671398 | 27.345157 | 28.069804 | 3464400 |

#convert the dataframe built from the csv file to the right input dataframe format

names = sorted(set(df['ticker']))

subdf = df[['ticker','date','adj_close']]

subdf.index = [datetime.strptime(d, '%Y-%m-%d') for d in subdf['date'].get_values()]

sorted_dates = sorted(set(subdf.index))

prices_df = pd.DataFrame(columns=names,index=sorted_dates)

print("shape:",prices_df.shape)

prices_df = subdf.pivot_table('adj_close', ['date'], 'ticker')

prices_df.index = pd.to_datetime(prices_df.index, format='%Y-%m-%d')

del prices_df.index.name

del prices_df.columns.name

prices_df.head()

shape: (14105, 3190)

There are in total 3190 stocks with more or less complete historical time series of prices.

| A | AA | AAL | AAMC | AAN | AAOI | AAON | AAP | AAPL | AAT | ... | ZIOP | ZIXI | ZLC | ZLTQ | ZMH | ZNGA | ZOES | ZQK | ZTS | ZUMZ | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1962-01-02 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1962-01-03 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1962-01-04 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1962-01-05 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1962-01-08 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | ... | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

5 rows × 3190 columns

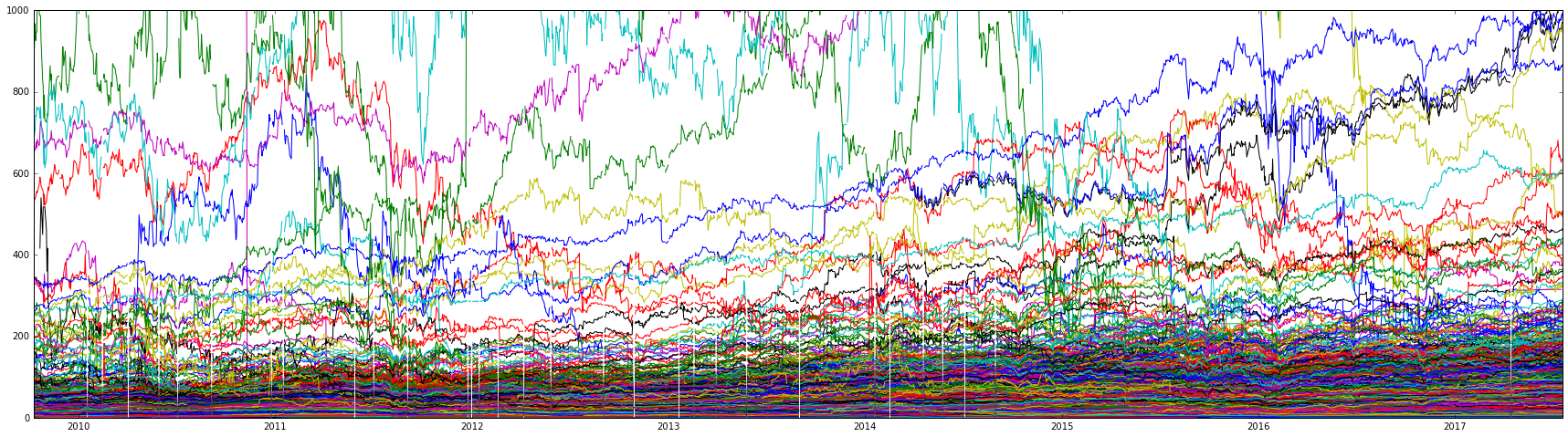

We consider only the last 2000 trading days, i.e. starting in roughly 2010.

#consider a smaller dataframe: only the last 2000 trading days

subperimeter_prices = prices_df[prices_df.columns[:]][-2000:]

plt.figure(figsize=(30,8))

plt.plot(subperimeter_prices)

plt.ylim([0,1000])

plt.show()

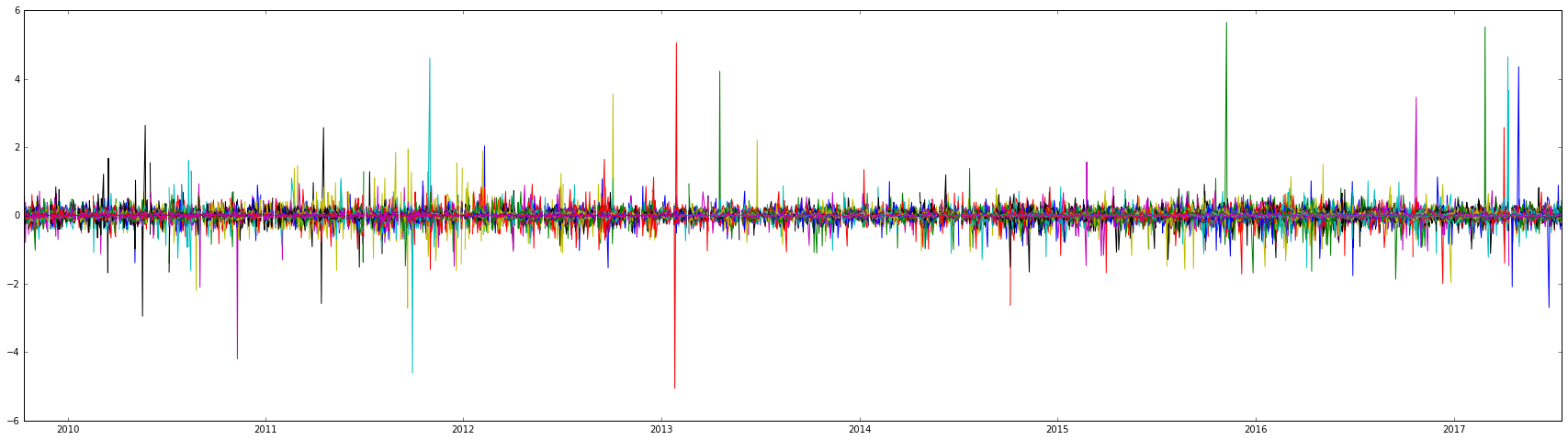

#convert prices to returns

X = pd.DataFrame(np.diff(np.log(subperimeter_prices),axis=0))

X.index = subperimeter_prices.index[1:]

X.columns = subperimeter_prices.columns

plt.figure(figsize=(30,8))

plt.plot(X)

plt.show()

X.shape

(1999, 3190)

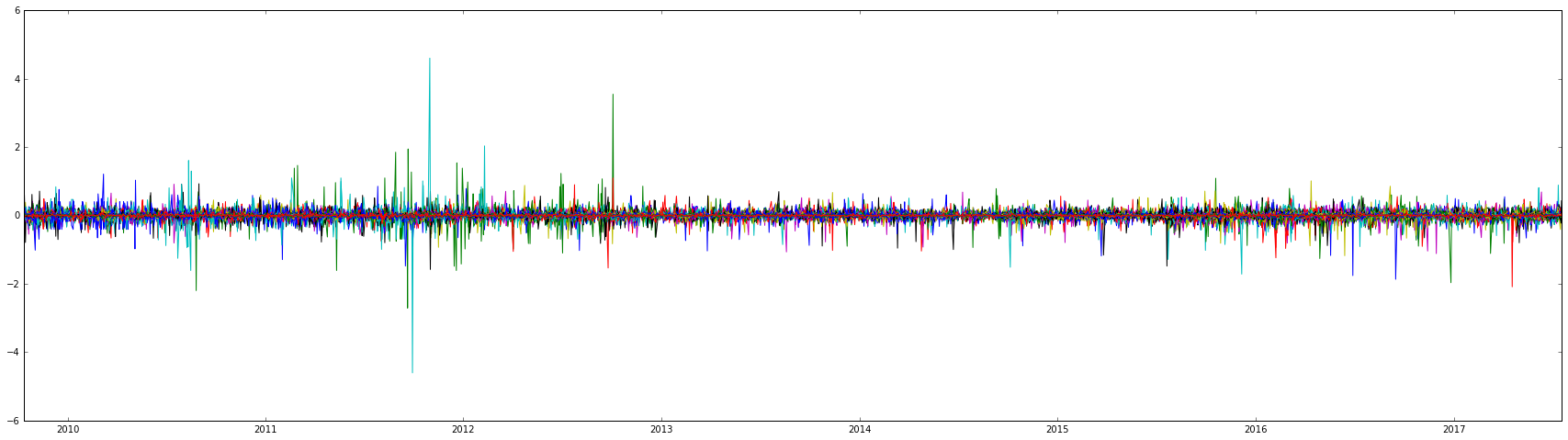

We keep only stocks having enough history (95% of non-missing values).

from ClusterLib.clusterlib import *

from ClusterLib.preprocessing import *

min_percent = 95

nb_clusters = 75

X = delete_small_historical(X,min_percent)

X.fillna(value=0,inplace=True)

plt.figure(figsize=(30,8))

plt.plot(X)

plt.show()

X.shape, X.isnull().values.any()

((1999, 2068), False)

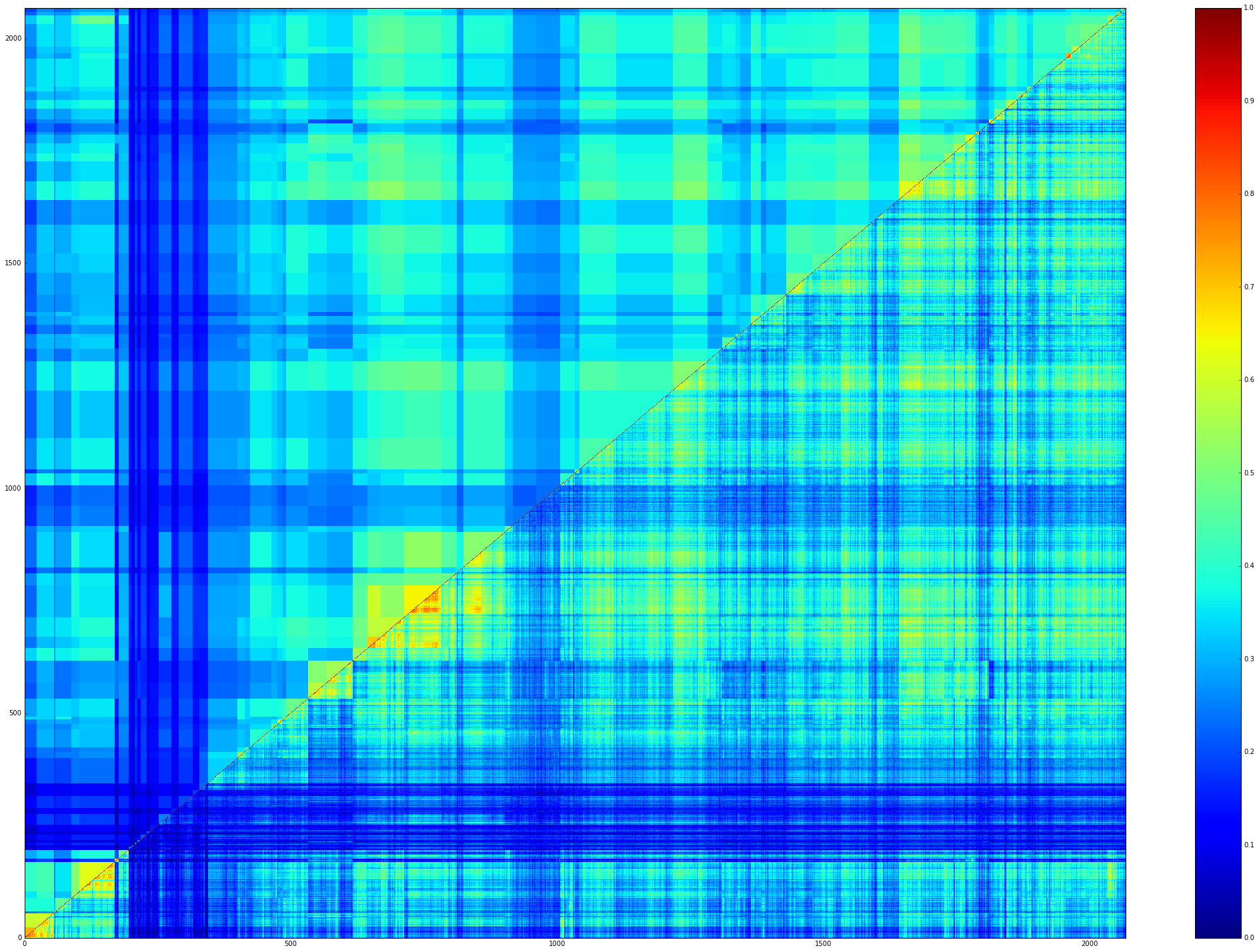

We compute the clusters using the Ward method working on distances based on Spearman correlation between stocks.

clusters, cluster_map = get_clusters(X,"ward","spearman",nb_clusters)

clusters

[array(['EXC', 'FE', 'AEE', 'CMS', 'DTE', 'LNT', 'PNW', 'SCG', 'ES', 'WEC',

'XEL', 'GXP', 'WR', 'ED', 'SO', 'AEP', 'DUK', 'D', 'NEE', 'EIX',

'PCG', 'ETR', 'PEG', 'PPL'], dtype=object),

array(['AWK', 'WTR', 'HE', 'MGEE', 'OTTR', 'EE', 'PNM', 'POR', 'AVA',

'IDA', 'ALE', 'NWE', 'SJI', 'NJR', 'WGL', 'NWN', 'SWX', 'BKH',

'UGI', 'ATO', 'VVC', 'CPK', 'UTL', 'CPN', 'NRG', 'CNP', 'OGE', 'NI',

'SRE', 'AES', 'MDU', 'NFG'], dtype=object),

array(['TSN', 'PPC', 'SAFM'], dtype=object),

array(['PM', 'MO', 'RAI', 'UVV', 'VGR', 'SYY', 'HSY', 'CAG', 'MDLZ', 'SJM',

'HRL', 'GIS', 'K', 'CPB', 'MKC', 'DF', 'FLO', 'PG', 'CL', 'KMB',

'CHD', 'CLX', 'TAP', 'BF_B', 'STZ', 'MNST', 'CCE', 'DPS', 'KO',

'PEP'], dtype=object),

array(['GPT', 'CDR', 'KRG', 'RPT', 'ADC', 'GTY', 'BFS', 'UBA', 'UHT',

'IRET', 'MNR', 'ALX', 'UMH', 'GOOD', 'OLP'], dtype=object),

array(['SBRA', 'HR', 'OHI', 'SNH', 'VTR', 'HCN', 'HCP', 'MPW', 'LTC',

'NHI', 'CUBE', 'EXR', 'PSA', 'MAA', 'AIV', 'CPT', 'ESS', 'UDR',

'AVB', 'EQR', 'ACC', 'EDR', 'ELS', 'SUI', 'EQIX', 'DFT', 'DLR',

'CLI', 'OFC', 'SLG', 'BXP', 'VNO', 'ARE', 'DEI', 'KRC', 'WRE',

'BDN', 'DRE', 'HIW', 'CUZ', 'PKY', 'GOV', 'FPO', 'FR', 'PLD', 'DCT',

'EGP', 'LXP', 'FSP', 'PSB', 'EPR', 'O', 'GGP', 'DDR', 'FRT', 'SPG',

'AKR', 'REG', 'KIM', 'WRI', 'SKT', 'MAC', 'TCO', 'FCE_A', 'CBL',

'PEI'], dtype=object),

array(['PZG', 'GORO', 'CDE', 'HL', 'GOLD', 'NEM', 'RGLD'], dtype=object),

array(['ARI', 'STWD', 'CIM', 'PMT', 'RWT', 'RAS', 'RSO', 'AI', 'STAR',

'NYMT', 'ARR', 'CYS', 'AGNC', 'NLY', 'DX', 'IVR', 'MFA', 'ANH',

'CMO'], dtype=object),

array(['BPTH', 'OLBK', 'MCBC', 'NATH', 'RVLT', 'FRBK', 'III'], dtype=object),

array(['BRT', 'ARCW', 'LOV', 'SIF'], dtype=object),

array(['CUR', 'CUTR', 'PTSI', 'BBGI', 'GAIA', 'LEE'], dtype=object),

array(['VTNR', 'REI', 'TAT', 'CIDM', 'GALT', 'NNVC'], dtype=object),

array(['INTX', 'WSTL', 'GTXI', 'OGXI', 'PRKR', 'PTX', 'NAVB', 'SNSS',

'OMEX', 'BDSI', 'RPRX'], dtype=object),

array(['NETE', 'PCYO', 'TWMC', 'EGAN', 'UNXL', 'BIOL', 'NEON'], dtype=object),

array(['MITK', 'GLUU', 'ZAGG', 'MEIP', 'NEO', 'PCYG', 'GFN', 'ISSC',

'STRT', 'PHMD', 'TEAR', 'CPSS', 'DAVE', 'TRXC', 'CALL', 'PERI'], dtype=object),

array(['PCTI', 'BHB', 'HOFT', 'MOFG', 'AMNB', 'PGC', 'RDI', 'TIS', 'HBCP',

'NRIM', 'FFNW', 'WSBF', 'CUNB', 'PPBI', 'FBIZ', 'SGBK', 'GBNK',

'PFBC', 'LION', 'HBNC', 'MBWM', 'ANCX', 'FFKT'], dtype=object),

array(['CFFI', 'DGAS', 'CASH', 'DJCO', 'SPNS', 'LCNB', 'BXC', 'PROV',

'HIFS', 'ITIC', 'CHMG', 'PLPM', 'CIX', 'LFVN'], dtype=object),

array(['REIS', 'SALM', 'AE', 'UCFC', 'ACHC', 'ADUS', 'AXDX', 'BSET',

'FLXS', 'SNAK', 'TESS', 'MLAB', 'UTMD', 'CORR', 'HCCI', 'CLCT',

'PATK', 'MDCA', 'WETF', 'NLS', 'CSV', 'PGTI', 'CECE', 'TREC', 'SPA',

'UFPT'], dtype=object),

array(['FNHC', 'HCI', 'UIHC', 'DXYN', 'ESCA', 'SQBG', 'DOOR', 'PFIS',

'CUI', 'PLUG', 'TREE', 'GTT', 'NYNY'], dtype=object),

array(['GALE', 'IDRA', 'CYTR', 'INO', 'SGYP', 'THLD', 'ARWR', 'ACHN',

'AGEN', 'KERX', 'HRTX', 'INSY', 'MDXG', 'TXMD', 'FCSC', 'OHRP'], dtype=object),

array(['LGND', 'LXRX', 'MNTA', 'ACOR', 'EBS', 'GHDX', 'SPPI', 'MDCO',

'RIGL', 'CRIS', 'EXEL', 'CYTK', 'SGMO', 'HALO', 'IMGN', 'CLDX',

'ALNY', 'NBIX', 'BCRX', 'GERN', 'NVAX', 'ZIOP', 'NKTR', 'PGNX',

'ARRY', 'IMMU', 'VNDA', 'DVAX', 'INFI', 'ANIP', 'OPK', 'SRPT',

'XOMA', 'VVUS', 'ARNA', 'OREX', 'MNKD', 'MYGN', 'EXAS', 'PDLI',

'OMER', 'BTX', 'CORT', 'BSTC', 'SCLN', 'ATRS', 'AMAG', 'CERS',

'BEAT', 'RMTI', 'AMRI', 'FOLD', 'ACAD', 'INSM', 'ANIK', 'RGEN'], dtype=object),

array(['GILD', 'BIIB', 'AMGN', 'CELG', 'ILMN', 'UTHR', 'ALKS', 'INCY',

'SGEN', 'VRTX', 'REGN', 'ALXN', 'BMRN'], dtype=object),

array(['PRGO', 'AGN', 'MYL', 'ENDP', 'VRX', 'DEPO', 'SCMP', 'LCI', 'AKRX',

'IPXL'], dtype=object),

array(['STAA', 'OSUR', 'QDEL', 'CSII', 'ELGX', 'NXTM', 'ABMD', 'SPNC',

'DXCM', 'PODD', 'IVC', 'OFIX', 'ANGO', 'BABY', 'MMSI', 'NUVA',

'WMGI', 'ABAX', 'LMNX', 'HAE', 'ICUI', 'IART', 'MASI', 'CNMD',

'TFX', 'STE', 'WST', 'ENSG', 'USPH', 'ALOG', 'LDR', 'VIVO', 'BCPC',

'NEOG', 'OMCL', 'CRVL', 'CRY', 'CBM', 'EXAC', 'SRDX'], dtype=object),

array(['AMED', 'AFAM', 'LHCG', 'HLS', 'CYH', 'LPNT', 'UHS', 'PMC', 'BKD',

'CSU', 'KND', 'SEM'], dtype=object),

array(['HUM', 'CI', 'UNH', 'AET', 'ANTM', 'WCG', 'CNC', 'MOH', 'GTS',

'MGLN'], dtype=object),

array(['BMY', 'MRK', 'PFE', 'LLY', 'ABT', 'JNJ'], dtype=object),

array(['ABC', 'CAH', 'MCK', 'ESRX', 'DVA', 'DGX', 'LH', 'OMI', 'XRAY',

'HSIC', 'PDCO', 'WOOF', 'CHE', 'MD', 'BAX', 'MDT', 'SYK', 'ZBH',

'BCR', 'BDX', 'ISRG', 'BSX', 'HOLX', 'HRC', 'VAR', 'EW', 'RMD',

'BRKR', 'MTD', 'TMO', 'WAT', 'A', 'PKI', 'ALGN', 'COO', 'CRL',

'PRXL', 'QGEN', 'IDXX', 'BIO', 'TECH'], dtype=object),

array(['SDRL', 'ATW', 'DO', 'RIG', 'PKD', 'BAS', 'KEG', 'RES', 'PES',

'UNT', 'HP', 'PTEN', 'SLB', 'BHI', 'HAL', 'FTI', 'NOV', 'DRQ',

'OII', 'OIS', 'SPN', 'CRR', 'BRS', 'CKH', 'HOS', 'TDW', 'MTRX',

'MDR', 'TESO', 'NR', 'HLX', 'TTI', 'WG', 'GEOS', 'IO'], dtype=object),

array(['NBL', 'APC', 'APA', 'DVN', 'OXY', 'COP', 'MRO', 'HES', 'MUR',

'PDCE', 'XEC', 'CXO', 'EOG', 'PXD', 'EGN', 'NFX', 'BP', 'CVX',

'XOM', 'INT', 'OKE', 'WMB', 'COG', 'EQT', 'RRC', 'CHK', 'GPOR',

'EGY', 'HK', 'GST', 'CLNE', 'REN', 'REXX', 'XCO', 'PQ', 'NOG',

'CRK', 'SGY', 'WTI', 'BBG', 'DNR', 'SM', 'CRZO', 'CLR', 'WLL',

'AXAS', 'CPE', 'AREX', 'MCF'], dtype=object),

array(['AWH', 'VR', 'ACGL', 'RE', 'RNR', 'AHL', 'AXS', 'WTM', 'AON', 'MMC',

'AJG', 'BRO', 'AFSI', 'XL', 'PGR', 'ALL', 'CB', 'CINF', 'MCY',

'ORI', 'PRA', 'THG', 'AFG', 'WRB', 'MKL', 'Y', 'ANAT', 'ERIE'], dtype=object),

array(['SNV', 'MTB', 'PNC', 'BBT', 'USB', 'WFC', 'FHN', 'CMA', 'ZION',

'RF', 'HBAN', 'STI', 'FITB', 'KEY', 'COF', 'AXP', 'DFS', 'STT',

'BK', 'NTRS', 'GS', 'MS', 'C', 'BAC', 'JPM'], dtype=object),

array(['BLK', 'EV', 'BEN', 'TROW', 'AMG', 'AMP', 'IVZ', 'LM', 'WDR', 'FII',

'SEIC', 'CNS', 'VRTS', 'LAZ', 'EVR', 'GHL', 'ITG', 'IBKR', 'PJC',

'RJF', 'SF', 'ETFC', 'AMTD', 'SCHW', 'NDAQ', 'CME', 'ICE', 'BRK_A',

'BRK_B', 'AFL', 'HIG', 'LNC', 'MET', 'PRU', 'PFG', 'TMK', 'UNM',

'AIZ', 'RGA', 'AIG', 'LUK', 'CNA', 'L'], dtype=object),

array(['CPF', 'HAFC', 'BANR', 'UCBI', 'FBP', 'BPOP', 'OFG', 'TBBK', 'NFBK',

'ORIT', 'FRME', 'PFS', 'INDB', 'FFBC', 'UBSI', 'FFIN', 'FNB', 'CBU',

'NBTB', 'IBOC', 'TRMK', 'WSBC', 'CHCO', 'STBA', 'CHFC', 'PRK',

'FFIC', 'BRKL', 'DCOM', 'BHLB', 'ISBC', 'OZRK', 'HOMB', 'PNFP',

'WAL', 'BPFH', 'PACW', 'COLB', 'UMBF', 'ONB', 'UMPQ', 'CVBF',

'GBCI', 'WABC', 'WTFC', 'BXS', 'FCF', 'FMBI', 'MBFI', 'TCBI',

'IBKC', 'HBHC', 'BOKF', 'CFR', 'PB', 'SBNY', 'VLY', 'FULT', 'BOH',

'CBSH', 'SIVB', 'CATY', 'EWBC', 'WBS', 'AF', 'NYCB', 'PBCT', 'NWBI',

'WAFD', 'CFFN', 'TFSL'], dtype=object),

array(['OB', 'ESGR', 'GLRE', 'MHLD', 'UFCS', 'IPCC', 'SAFT', 'AGII',

'NAVG', 'RLI', 'SIGI', 'AMSF', 'EIG', 'BOFI', 'UVE', 'BLX', 'OPY',

'FCNCA', 'HTH', 'HMN', 'KMPR', 'FFG', 'AEL', 'CNO', 'PZN', 'MKTX',

'BGCP', 'SFE'], dtype=object),

array(['NICK', 'BANC', 'FBC', 'PSTB', 'SBCF', 'HTBK', 'SNBC', 'CNOB',

'FDEF', 'CHFN', 'CCF', 'EBTC', 'IHC'], dtype=object),

array(['BMTC', 'FISI', 'WSFS', 'PCBK', 'EFSC', 'HFWA', 'ABCB', 'WTBA',

'BUSE', 'TOWN', 'SBSI', 'FBNC', 'AROW', 'GABC', 'GSBC', 'HTLF',

'UVSP', 'FCBC', 'LBAI', 'TCBK', 'STL', 'UBSH', 'TMP', 'BANF',

'SRCE', 'THFF', 'TRST', 'LKFN', 'SASR', 'SFNC', 'RNST', 'WASH',

'CTBI', 'SYBT', 'CAC', 'MSFG', 'BKMU', 'PEBO', 'UBNK', 'CSFL',

'EGBN', 'COBZ', 'FLIC', 'BSRR', 'OCFC', 'OKSB', 'RBCAA', 'ESSA',

'CSBK', 'EBSB', 'BNCL', 'KRNY', 'SENEA', 'NUTR', 'ODC', 'DGICA',

'HALL', 'EMCI', 'GBLI', 'STFC', 'CTO', 'CIA', 'NHC', 'CASS', 'WEYS',

'TBNK', 'BFIN', 'CZNC', 'BDGE', 'CCNE', 'FNLC', 'ATLO', 'BWINB',

'CCBG', 'PWOD', 'CNBKA', 'BMRC', 'NKSH'], dtype=object),

array(['HTGC', 'MAIN', 'TCAP', 'TICC', 'PNNT', 'PSEC', 'AINV', 'ARCC',

'BKCC', 'FSC', 'CSWC', 'MVC', 'GAIN', 'GLAD'], dtype=object),

array(['JAKK', 'WWE', 'FLWS', 'AVHI', 'TTGT', 'ENZ', 'OME', 'DMRC', 'SNMX',

'ARAY', 'ARQL', 'LWAY', 'ISRL', 'ATRI', 'NVEC', 'OFLX', 'USLM',

'HBIO', 'RTIX', 'CWCO', 'KMG', 'PRSC', 'CFI', 'HCKT', 'PLUS',

'WINA', 'NATR', 'JOUT', 'ALCO', 'LMNR', 'HNRG', 'AIQ', 'RDNT',

'HNH', 'PLPC', 'SGA', 'BDE', 'NMRX', 'SHLO', 'BREW', 'SAM', 'MPAA',

'ATRC', 'HSTM'], dtype=object),

array(['CFNB', 'GRIF', 'GSIT', 'RELL', 'LINC', 'IVAC', 'QTM', 'MOSY',

'RBCN', 'CLUB', 'ATEC', 'AVNW', 'CVO', 'AHC', 'MNI', 'PRGX', 'RST',

'DWSN', 'MIND', 'AOI', 'FVE', 'MSL', 'RTK', 'JMBA', 'PCO', 'FHCO',

'PTIE', 'CTG', 'GSOL', 'HIL', 'SEAC', 'LUB', 'RSYS', 'CTIC', 'PPHM',

'BIOS', 'CPST', 'FCEL', 'XRM', 'UEC', 'URG', 'CYTX', 'VICL', 'HDNG',

'GMO', 'SPRT'], dtype=object),

array(['ARTNA', 'YORW', 'CTWS', 'MSEX', 'SJW', 'AWR', 'CWT', 'IDT', 'CBB',

'CNSL', 'GNCMA', 'ATNI', 'SHEN', 'CALM', 'CORE', 'CVGW', 'BGS',

'THS', 'WDFC', 'LNCE', 'JJSF', 'LANC', 'TR', 'JBSS', 'FARM', 'COKE',

'FIZZ'], dtype=object),

array(['LRN', 'BPI', 'CECO', 'CPLA', 'STRA', 'APEI', 'LOPE', 'GHC', 'UTI'], dtype=object),

array(['HAIN', 'VRSK', 'ABCO', 'INWK', 'MED', 'NTRI', 'CHDN', 'ISCA',

'TRK', 'MTN', 'HELE', 'HSNI', 'NCMI', 'RGS', 'CENTA', 'PBH', 'UHAL',

'VRTU', 'EXLS', 'MMS', 'SYNT', 'CSGS', 'CVG', 'SYKE', 'TTEC',

'PRFT', 'LYV', 'CSGP', 'JCOM', 'LDOS', 'CACI', 'MANT', 'HCSG',

'CTAS', 'UNF', 'ABM', 'ROL', 'ACXM', 'HI', 'BCO', 'SCI', 'SSP',

'MDP', 'NYT', 'RRD', 'JW_A', 'SCHL', 'RECN', 'HSII', 'KFY', 'ASGN',

'DLX', 'KFRC', 'MAN', 'RHI', 'KELYA', 'TBI', 'FCN', 'HURN', 'TILE',

'KNL', 'SCS', 'HNI', 'MLHR', 'VOXX', 'NSR', 'OSIS', 'IRBT', 'UEIC'], dtype=object),

array(['ERII', 'STRL', 'GLDD', 'ORN', 'LTS', 'COWN', 'ATRO', 'INTL', 'AGM',

'BBSI', 'CWST', 'CRMT', 'MG', 'CMTL', 'RNWK', 'ETM', 'PKOH', 'MYRG',

'GHM', 'TISI', 'CLH', 'ECOL', 'HURC', 'NNBR', 'SEB', 'SP', 'AMSWA',

'TYPE', 'MRLN', 'LBY', 'LCUT', 'CRD_B', 'KVHI', 'AGYS', 'CRAI',

'LABL', 'ICFI', 'FC', 'GPX', 'VICR', 'CDI', 'LYTS', 'HZO', 'LDL',

'ELY', 'SPAR', 'FORR', 'TRC', 'ARC', 'SYX', 'HHS', 'MPX', 'CCRN',

'MLR', 'NWLI', 'NC', 'WMAR', 'MCRI', 'HVT', 'NPK', 'MTSC', 'RAVN',

'DEL', 'FIX', 'BRC', 'MATW', 'EXPO', 'NCI', 'MYE', 'MCS', 'NSP',

'BELFB', 'BBOX', 'DAKT', 'AAON', 'MEI', 'FSS', 'ROG', 'CTS', 'PKE',

'LNDC', 'ACET', 'CSS', 'DHIL', 'IIIN', 'EBF', 'VVI', 'GBL', 'WHG',

'NEWS', 'PICO', 'UFI', 'MLNK', 'EXTR', 'VDSI', 'DCO', 'VSEC', 'CBZ',

'DGII', 'DSPG', 'ESIO', 'KOPN', 'COHU', 'IXYS', 'MRCY', 'XOXO'], dtype=object),

array(['AZZ', 'POWL', 'AIMC', 'WIRE', 'AIN', 'BDC', 'ENS', 'NPO', 'CIR',

'SNHY', 'ASTE', 'EME', 'MLI', 'B', 'WTS', 'AIT', 'KAMN', 'MSA',

'FELE', 'ROLL', 'TTEK', 'BGG', 'ESE', 'CMCO', 'KAI', 'JBT', 'TNC',

'SXI', 'BMI', 'GRC', 'NNI', 'MOD', 'SUP', 'AYR', 'RUSHA', 'TRS',

'MGRC', 'MINI', 'DORM', 'SMP', 'ALG', 'ATSG', 'SRI', 'ACCO', 'MWA',

'AVD', 'FOE', 'SCL', 'SHLM', 'KWR', 'POL', 'FUL', 'MTX', 'SXT',

'OLN', 'KOP', 'TG', 'IPHS', 'HWKN', 'IOSP', 'OMN', 'ANDE', 'CCC',

'DAR', 'LXU'], dtype=object),

array(['EPM', 'NGS', 'PHX', 'GIFI', 'HWCC', 'USAP', 'LAYN', 'AP', 'BOOM',

'CVGI', 'TWIN', 'ASCMA', 'NWPX', 'FSTR', 'PHIIK', 'EZPW', 'FCFS',

'WRLD', 'ECPG', 'PRAA', 'DDD', 'SSYS', 'AMSC', 'MCHX', 'ENOC',

'SPWR', 'CVA', 'ORA'], dtype=object),

array(['MCD', 'SBUX', 'YUM', 'CMG', 'PNRA', 'TAST', 'BH', 'DENN', 'RUTH',

'DRI', 'EAT', 'CBRL', 'CAKE', 'TXRH', 'BOBE', 'DIN', 'RT', 'BJRI',

'BWLD', 'DPZ', 'PZZA', 'WEN', 'RRGB', 'JACK', 'SONC'], dtype=object),

array(['SVU', 'KR', 'WFM', 'VLGEA', 'IMKTA', 'WMK', 'SPTN', 'UNFI'], dtype=object),

array(['DEST', 'DXLG', 'BGFV', 'SCVL', 'SMRT', 'SSI', 'PSMT', 'MNRO',

'CASY', 'FRED', 'BKS', 'CTRN', 'KIRK', 'TUES', 'BBW', 'CONN',

'BONT', 'CBK', 'NWY', 'BEBE', 'RGR'], dtype=object),

array(['COH', 'VFC', 'PVH', 'RL', 'HBI', 'NKE', 'UAA', 'SKX', 'CROX',

'DECK', 'SHOO', 'WWW', 'MOV', 'PERY', 'ICON', 'GIII', 'COLM', 'OXM'], dtype=object),

array(['AAP', 'AZO', 'ORLY', 'TGT', 'COST', 'WMT', 'ROST', 'TJX', 'BIG',

'DLTR'], dtype=object),

array(['ODP', 'SPLS', 'BBY', 'GME', 'AAN', 'RCII', 'PIR', 'BBBY', 'WSM',

'SBH', 'TSCO', 'ULTA', 'VSI', 'CAB', 'DKS', 'HIBB', 'FINL', 'FL',

'CRI', 'PLCE', 'GPS', 'LB', 'AEO', 'ANF', 'GES', 'ZUMZ', 'DSW',

'ASNA', 'CHS', 'BKE', 'CATO', 'GCO', 'SHLD', 'JCP', 'KSS', 'DDS',

'JWN', 'M'], dtype=object),

array(['TRUE', 'AMD', 'MU', 'MRVL', 'NVDA', 'AMKR', 'KLAC', 'LRCX', 'AMAT',

'TER', 'CRUS', 'AVGO', 'SWKS', 'MXIM', 'XLNX', 'MCHP', 'ADI', 'TXN',

'CAVM', 'CY', 'DIOD', 'IDTI', 'MSCC', 'SLAB', 'SMTC', 'MPWR',

'POWI', 'PLAB', 'CCMP', 'AEIS', 'BRKS', 'ENTG', 'MKSI', 'UCTT',

'NANO', 'RTEC', 'ACLS', 'PDFS', 'SIGM', 'IMMR', 'SYNA', 'KEM',

'CEVA', 'CREE', 'VECO', 'FORM', 'RMBS', 'LSCC', 'XCRA'], dtype=object),

array(['TTWO', 'ATVI', 'EA', 'NFLX', 'BIDU', 'EXPE', 'GOOGL', 'AMZN',

'PCLN', 'AKAM', 'VRSN', 'CHKP', 'DOX', 'CVLT', 'VMW', 'CRM', 'CTXS',

'RHT', 'CDNS', 'SNPS', 'ADSK', 'ANSS', 'ADBE', 'INTU', 'AZPN',

'NUAN', 'STX', 'WDC', 'HPQ', 'XRX', 'CTSH', 'ACN', 'IBM', 'CSCO',

'INTC', 'SYMC', 'MSFT', 'CA', 'ORCL', 'AAPL', 'MSI', 'EBAY', 'QCOM'], dtype=object),

array(['OCLR', 'INFN', 'CIEN', 'FNSR', 'BRCD', 'NTAP', 'FFIV', 'JNPR',

'OLED', 'IPGP', 'COHR', 'IIVI', 'FARO', 'CGNX', 'LFUS', 'TTMI',

'JBL', 'SANM', 'BHE', 'PLXS', 'NSIT', 'SCSC', 'SNX', 'TECD', 'ARW',

'AVT', 'AVX', 'VSH', 'GRMN', 'ITRI', 'NATI', 'TRMB', 'FLIR', 'HRS',

'GLW', 'APH', 'TEL', 'SONS', 'SNCR', 'HLIT', 'NTCT', 'DLB', 'IDCC',

'ADTN', 'ARRS', 'VSAT', 'NTGR', 'PLT', 'DHX', 'MXWL', 'CRAY',

'SMCI', 'DBD', 'NCR', 'PAY', 'UIS', 'ZBRA', 'BID', 'EFII', 'WEX',

'DGI', 'LORL', 'SATS'], dtype=object),

array(['CPSI', 'QSII', 'ATHN', 'CERN', 'MDRX', 'IRDM', 'ORBC', 'CCOI',

'LVLT', 'EGHT', 'VG', 'CLFD', 'QUIK', 'CAMP', 'WBMD', 'VRNT',

'PEGA', 'MSTR', 'MANH', 'TYL', 'ULTI', 'EGOV', 'EPAY', 'PRGS',

'ACIW', 'BLKB', 'CALD', 'GUID', 'MDSO', 'LOGM', 'PRO', 'STMP',

'OSTK', 'SHOR', 'EHTH', 'PETS', 'LQDT', 'CATM', 'BCOR', 'LPSN',

'EBIX', 'MGI', 'INAP', 'LLNW', 'CACC', 'ACTG', 'HMSY', 'WTW',

'SIRI', 'CETV', 'KTOS', 'VHC', 'SFLY', 'ZIXI', 'TIVO', 'TZOO'], dtype=object),

array(['UNP', 'CSX', 'NSC', 'GWR', 'KSU', 'MSM', 'FAST', 'GWW', 'JCI',

'GE', 'DHR', 'HON', 'UTX', 'ITW', 'MMM', 'PCAR', 'CAT', 'CMI', 'IR',

'ETN', 'PH', 'EMR', 'ROK', 'WAB', 'AME', 'ROP', 'CFX', 'PNR', 'ITT',

'CR', 'DOV', 'FLS', 'RBC', 'ATU', 'KMT', 'TKR', 'NDSN', 'GGG',

'IEX', 'DCI', 'LECO'], dtype=object),

array(['ACM', 'CBI', 'KBR', 'FLR', 'JEC', 'DY', 'MTZ', 'PWR', 'AGX',

'PRIM', 'NCS', 'FOR', 'BECN', 'AEGN', 'GVA', 'TPC', 'TITN', 'AGCO',

'DE', 'LNN', 'VMI', 'RAIL', 'ARII', 'GBX', 'TRN', 'CAR', 'HTZ',

'OSK', 'MTW', 'TEX', 'WNC', 'NAV', 'MTOR', 'WBC', 'TGH', 'HEES',

'URI', 'GTLS', 'TWI', 'DXPE', 'AXE', 'WCC', 'BGC', 'HSC'], dtype=object),

array(['GPK', 'ATR', 'BMS', 'SON', 'AVY', 'SEE', 'GEF', 'SLGN', 'BLL',

'CCK', 'UFS', 'KS', 'IP', 'PKG', 'SWM', 'CLW', 'GLT', 'NP'], dtype=object),

array(['IPI', 'CF', 'MOS', 'DD', 'DOW', 'HUN', 'CBT', 'FMC', 'CE', 'EMN',

'WLK', 'APD', 'PX', 'IFF', 'ECL', 'PPG', 'RPM', 'NEU', 'ASH', 'ALB',

'GRA', 'CMP', 'MON'], dtype=object),

array(['CLF', 'AKS', 'X', 'ZEUS', 'SCHN', 'CMC', 'RS', 'NUE', 'STLD',

'CRS', 'WOR', 'FCX', 'SCCO', 'ARNC', 'CENX', 'GSM', 'KALU', 'HAYN',

'MTRN'], dtype=object),

array(['HFC', 'TSO', 'VLO', 'CVI', 'ALJ', 'DK'], dtype=object),

array(['NNA', 'DHT', 'FRO', 'NAT', 'TNK', 'PEIX', 'GPRE', 'REX', 'NM',

'SB', 'WLB', 'GLNG', 'SFL', 'TK', 'FTK', 'LNG', 'MNTX', 'KRO', 'NL'], dtype=object),

array(['AAL', 'DAL', 'UAL', 'JBLU', 'ALK', 'LUV', 'ALGT', 'HA', 'SKYW'], dtype=object),

array(['HTLD', 'KNX', 'WERN', 'ODFL', 'JBHT', 'LSTR', 'ARCB', 'SAIA',

'CGI', 'MRTN', 'KEX', 'MATX', 'FDX', 'UPS', 'CHRW', 'EXPD', 'AAWW',

'FWRD', 'HUBG', 'ECHO', 'XPO', 'USAK', 'YRCW'], dtype=object),

array(['LMT', 'NOC', 'RTN', 'GD', 'LLL', 'SPR', 'BA', 'COL', 'HXL', 'TXT',

'TDG', 'TGI', 'AVAV', 'CUB', 'ESL', 'MOG_A', 'CW', 'TDY', 'AIR',

'HEI'], dtype=object),

array(['CMLS', 'EVC', 'GTN', 'NXST', 'SBGI', 'CNK', 'RGC', 'SNI', 'DISCA',

'DISCK', 'DIS', 'FOX', 'FOXA', 'TWX', 'CBS', 'VIAB', 'DISH',

'CMCSA', 'LBTYA'], dtype=object),

array(['SBAC', 'AMT', 'CCI', 'VOD', 'CTL', 'T', 'VZ', 'TDS', 'USM', 'S',

'TMUS'], dtype=object),

array(['HRG', 'SPB', 'HLF', 'NUS', 'USNA', 'IPAR', 'REV', 'ADM', 'BG',

'FDP', 'INGR', 'CCL', 'RCL', 'CHH', 'MAR', 'WYN', 'IRM', 'LAMR',

'IPG', 'OMC', 'EL', 'TRI', 'SMG', 'NWL', 'TUP', 'CCO', 'CPA', 'STC',

'CLGX', 'FNF', 'ALR', 'HRB', 'RAD', 'CVS', 'WBA', 'SRCL', 'WCN',

'RSG', 'WM', 'MA', 'V', 'MORN', 'MCO', 'FDS', 'MSCI', 'EFX', 'FICO',

'IT', 'BR', 'DST', 'EEFT', 'MIDD', 'G', 'ADP', 'PAYX', 'FIS',

'FISV', 'JKHY', 'ADS', 'WU', 'GPN', 'TSS'], dtype=object),

array(['NVR', 'MHO', 'PHM', 'TOL', 'DHI', 'LEN', 'KBH', 'MDC', 'MTH',

'BZH', 'HOV'], dtype=object),

array(['KMX', 'AN', 'LAD', 'ABG', 'SAH', 'GPI', 'PAG', 'CTB', 'GT', 'THRM',

'F', 'GNTX', 'AXL', 'BWA', 'DAN', 'TEN'], dtype=object),

array(['TREX', 'AMWD', 'BLDR', 'CVCO', 'APOG', 'ROCK', 'NX', 'GFF', 'SSD',

'UFPI', 'EXP', 'MLM', 'VMC', 'LPX', 'OC', 'USG', 'AWI', 'MAS',

'MHK', 'SHW', 'HD', 'LOW', 'CPRT', 'POOL', 'GPC', 'LKQ', 'WSO',

'AOS', 'LII', 'AYI', 'TTC', 'CSL', 'SNA', 'SWK', 'SCSS', 'TPX',

'ETH', 'LZB', 'LEG', 'WHR', 'HAS', 'MAT', 'HOG', 'BC', 'PII', 'SIG',

'TIF', 'LL', 'THO', 'WGO'], dtype=object),

array(['AHT', 'FCH', 'RHP', 'HT', 'HPT', 'SHO', 'HST', 'DRH', 'LHO', 'CXW',

'GEO', 'WY', 'PCH', 'RYN', 'JOE', 'CBG', 'JLL', 'HF', 'KW'], dtype=object),

array(['MGM', 'LVS', 'WYNN', 'PENN', 'BYD', 'PNK', 'IGT', 'SGMS'], dtype=object),

array(['MTG', 'RDN', 'AGO', 'MBI', 'ASPS', 'OCN', 'PHH', 'WAC'], dtype=object)]

This can be quite puzzling without knowing the stocks. So we are going to study these clusters a bit further… Below we sort the rows and columns of the correlation matrix using the dendrogram computed by the Ward method. We can see that blocks appear on the diagonal. These blocks correspond to the clusters. Some are strongly correlated, some less so. Some are far (uncorrelated) from the rest of the stocks, some are mildly correlated with nearly every other stocks.

display_filtered_correlation(X,nb_clusters=nb_clusters,method="ward",type_correl="spearman")

Now, we are trying to name automatically these clusters based on descriptive features for each stock. Here we will use only industry related information and rating, but one can be more imaginative to add various different factors.

#import features describing the stocks

features = pd.read_csv('stock_features.csv')

features.index = features['Unnamed: 0']

del features.index.name

main_features = features[['INDUSTRY_SECTOR','INDUSTRY_GROUP','INDUSTRY_SUBGROUP','RTG_SP_LT_LC_ISSUER_CREDIT']].T

main_features = main_features[X.columns]

main_features.head()

| A | AAL | AAN | AAON | AAP | AAPL | AAWW | ABAX | ABC | ABCB | ... | YRCW | YUM | ZAGG | ZBH | ZBRA | ZEUS | ZION | ZIOP | ZIXI | ZUMZ | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| INDUSTRY_SECTOR | Industrial | Consumer, Cyclical | Consumer, Non-cyclical | Industrial | Consumer, Cyclical | Technology | Industrial | Consumer, Non-cyclical | Consumer, Non-cyclical | Financial | ... | Industrial | Consumer, Cyclical | Industrial | Consumer, Non-cyclical | Industrial | Industrial | Financial | Consumer, Non-cyclical | Communications | Consumer, Cyclical |

| INDUSTRY_GROUP | Electronics | Airlines | Commercial Services | Building Materials | Retail | Computers | Transportation | Healthcare-Products | Pharmaceuticals | Banks | ... | Transportation | Retail | Electronics | Healthcare-Products | Machinery-Diversified | Metal Fabricate/Hardware | Banks | Biotechnology | Internet | Retail |

| INDUSTRY_SUBGROUP | Electronic Measur Instr | Airlines | Rental Auto/Equipment | Bldg Prod-Air&Heating | Retail-Auto Parts | Computers | Transport-Air Freight | Medical Instruments | Medical-Whsle Drug Dist | Commer Banks-Southern US | ... | Transport-Truck | Retail-Restaurants | Electronic Compo-Misc | Medical Products | Machinery-General Indust | Metal Products-Distrib | Commer Banks-Western US | Medical-Biomedical/Gene | Internet Security | Retail-Sporting Goods |

| RTG_SP_LT_LC_ISSUER_CREDIT | BBB+ | BB- | NaN | NaN | BBB- | AA+ | NaN | NaN | A- | NaN | ... | B- | BB | NaN | BBB | BB- | NaN | BBB- | NaN | NaN | NaN |

4 rows × 2067 columns

We compute the name for the clusters:

clusters, cluster_names = build_named_clustering(X,main_features,nb_clusters)

We can see below that some clusters correspond very precisely to a given (sub)industry:

for cluster,cluster_name in zip(clusters,cluster_names):

print(cluster_name + "\t\t| size: " + str(len(cluster)) + "\t\t| mean correl: " + "%.2f" % X[cluster].corr(method="spearman").values.mean())

print(cluster,end="\n\n")

Electric-Integrated/(0.75) | size: 24 | mean correl: 0.72

['EXC' 'FE' 'AEE' 'CMS' 'DTE' 'LNT' 'PNW' 'SCG' 'ES' 'WEC' 'XEL' 'GXP' 'WR'

'ED' 'SO' 'AEP' 'DUK' 'D' 'NEE' 'EIX' 'PCG' 'ETR' 'PEG' 'PPL']

Utilities/(0.65) | size: 32 | mean correl: 0.60

['AWK' 'WTR' 'HE' 'MGEE' 'OTTR' 'EE' 'PNM' 'POR' 'AVA' 'IDA' 'ALE' 'NWE'

'SJI' 'NJR' 'WGL' 'NWN' 'SWX' 'BKH' 'UGI' 'ATO' 'VVC' 'CPK' 'UTL' 'CPN'

'NRG' 'CNP' 'OGE' 'NI' 'SRE' 'AES' 'MDU' 'NFG']

Poultry/(0.8) | size: 3 | mean correl: 0.66

['TSN' 'PPC' 'SAFM']

Beverages/(0.33) | size: 30 | mean correl: 0.47

['PM' 'MO' 'RAI' 'UVV' 'VGR' 'SYY' 'HSY' 'CAG' 'MDLZ' 'SJM' 'HRL' 'GIS' 'K'

'CPB' 'MKC' 'DF' 'FLO' 'PG' 'CL' 'KMB' 'CHD' 'CLX' 'TAP' 'BF_B' 'STZ'

'MNST' 'CCE' 'DPS' 'KO' 'PEP']

REITS-Shopping Centers/(0.44) | size: 15 | mean correl: 0.53

['GPT' 'CDR' 'KRG' 'RPT' 'ADC' 'GTY' 'BFS' 'UBA' 'UHT' 'IRET' 'MNR' 'ALX'

'UMH' 'GOOD' 'OLP']

REITS/(0.71) | size: 66 | mean correl: 0.62

['SBRA' 'HR' 'OHI' 'SNH' 'VTR' 'HCN' 'HCP' 'MPW' 'LTC' 'NHI' 'CUBE' 'EXR'

'PSA' 'MAA' 'AIV' 'CPT' 'ESS' 'UDR' 'AVB' 'EQR' 'ACC' 'EDR' 'ELS' 'SUI'

'EQIX' 'DFT' 'DLR' 'CLI' 'OFC' 'SLG' 'BXP' 'VNO' 'ARE' 'DEI' 'KRC' 'WRE'

'BDN' 'DRE' 'HIW' 'CUZ' 'PKY' 'GOV' 'FPO' 'FR' 'PLD' 'DCT' 'EGP' 'LXP'

'FSP' 'PSB' 'EPR' 'O' 'GGP' 'DDR' 'FRT' 'SPG' 'AKR' 'REG' 'KIM' 'WRI'

'SKT' 'MAC' 'TCO' 'FCE_A' 'CBL' 'PEI']

Gold Mining/(0.73) | size: 7 | mean correl: 0.67

['PZG' 'GORO' 'CDE' 'HL' 'GOLD' 'NEM' 'RGLD']

REITS-Mortgage/(0.97) | size: 19 | mean correl: 0.47

['ARI' 'STWD' 'CIM' 'PMT' 'RWT' 'RAS' 'RSO' 'AI' 'STAR' 'NYMT' 'ARR' 'CYS'

'AGNC' 'NLY' 'DX' 'IVR' 'MFA' 'ANH' 'CMO']

Retail-Restaurants/B-/(0.25) | size: 7 | mean correl: 0.23

['BPTH' 'OLBK' 'MCBC' 'NATH' 'RVLT' 'FRBK' 'III']

Private Equity/(0.25) | size: 4 | mean correl: 0.29

['BRT' 'ARCW' 'LOV' 'SIF']

Radio/B+/(0.29) | size: 6 | mean correl: 0.27

['CUR' 'CUTR' 'PTSI' 'BBGI' 'GAIA' 'LEE']

E-Services/Consulting/(0.25) | size: 6 | mean correl: 0.25

['VTNR' 'REI' 'TAT' 'CIDM' 'GALT' 'NNVC']

Marine Services/(0.15) | size: 11 | mean correl: 0.22

['INTX' 'WSTL' 'GTXI' 'OGXI' 'PRKR' 'PTX' 'NAVB' 'SNSS' 'OMEX' 'BDSI'

'RPRX']

Retail-Music Store/(0.25) | size: 7 | mean correl: 0.21

['NETE' 'PCYO' 'TWMC' 'EGAN' 'UNXL' 'BIOL' 'NEON']

Trucking&Leasing/(0.11) | size: 16 | mean correl: 0.14

['MITK' 'GLUU' 'ZAGG' 'MEIP' 'NEO' 'PCYG' 'GFN' 'ISSC' 'STRT' 'PHMD' 'TEAR'

'CPSS' 'DAVE' 'TRXC' 'CALL' 'PERI']

Commer Banks-Western US/(0.16) | size: 23 | mean correl: 0.25

['PCTI' 'BHB' 'HOFT' 'MOFG' 'AMNB' 'PGC' 'RDI' 'TIS' 'HBCP' 'NRIM' 'FFNW'

'WSBF' 'CUNB' 'PPBI' 'FBIZ' 'SGBK' 'GBNK' 'PFBC' 'LION' 'HBNC' 'MBWM'

'ANCX' 'FFKT']

Savings&Loans/(0.11) | size: 14 | mean correl: 0.16

['CFFI' 'DGAS' 'CASH' 'DJCO' 'SPNS' 'LCNB' 'BXC' 'PROV' 'HIFS' 'ITIC'

'CHMG' 'PLPM' 'CIX' 'LFVN']

Communications/B/(0.12) | size: 26 | mean correl: 0.20

['REIS' 'SALM' 'AE' 'UCFC' 'ACHC' 'ADUS' 'AXDX' 'BSET' 'FLXS' 'SNAK' 'TESS'

'MLAB' 'UTMD' 'CORR' 'HCCI' 'CLCT' 'PATK' 'MDCA' 'WETF' 'NLS' 'CSV' 'PGTI'

'CECE' 'TREC' 'SPA' 'UFPT']

Bldg Prod-Doors&Windows/BB/(0.14) | size: 13 | mean correl: 0.18

['FNHC' 'HCI' 'UIHC' 'DXYN' 'ESCA' 'SQBG' 'DOOR' 'PFIS' 'CUI' 'PLUG' 'TREE'

'GTT' 'NYNY']

Medical-Drugs/(0.2) | size: 16 | mean correl: 0.23

['GALE' 'IDRA' 'CYTR' 'INO' 'SGYP' 'THLD' 'ARWR' 'ACHN' 'AGEN' 'KERX'

'HRTX' 'INSY' 'MDXG' 'TXMD' 'FCSC' 'OHRP']

Biotechnology/(0.52) | size: 56 | mean correl: 0.33

['LGND' 'LXRX' 'MNTA' 'ACOR' 'EBS' 'GHDX' 'SPPI' 'MDCO' 'RIGL' 'CRIS'

'EXEL' 'CYTK' 'SGMO' 'HALO' 'IMGN' 'CLDX' 'ALNY' 'NBIX' 'BCRX' 'GERN'

'NVAX' 'ZIOP' 'NKTR' 'PGNX' 'ARRY' 'IMMU' 'VNDA' 'DVAX' 'INFI' 'ANIP'

'OPK' 'SRPT' 'XOMA' 'VVUS' 'ARNA' 'OREX' 'MNKD' 'MYGN' 'EXAS' 'PDLI'

'OMER' 'BTX' 'CORT' 'BSTC' 'SCLN' 'ATRS' 'AMAG' 'CERS' 'BEAT' 'RMTI'

'AMRI' 'FOLD' 'ACAD' 'INSM' 'ANIK' 'RGEN']

Biotechnology/(0.29) | size: 13 | mean correl: 0.52

['GILD' 'BIIB' 'AMGN' 'CELG' 'ILMN' 'UTHR' 'ALKS' 'INCY' 'SGEN' 'VRTX'

'REGN' 'ALXN' 'BMRN']

Medical-Generic Drugs/(0.46) | size: 10 | mean correl: 0.43

['PRGO' 'AGN' 'MYL' 'ENDP' 'VRX' 'DEPO' 'SCMP' 'LCI' 'AKRX' 'IPXL']

Healthcare-Products/(0.53) | size: 40 | mean correl: 0.40

['STAA' 'OSUR' 'QDEL' 'CSII' 'ELGX' 'NXTM' 'ABMD' 'SPNC' 'DXCM' 'PODD'

'IVC' 'OFIX' 'ANGO' 'BABY' 'MMSI' 'NUVA' 'WMGI' 'ABAX' 'LMNX' 'HAE' 'ICUI'

'IART' 'MASI' 'CNMD' 'TFX' 'STE' 'WST' 'ENSG' 'USPH' 'ALOG' 'LDR' 'VIVO'

'BCPC' 'NEOG' 'OMCL' 'CRVL' 'CRY' 'CBM' 'EXAC' 'SRDX']

Medical-Hospitals/(0.47) | size: 12 | mean correl: 0.47

['AMED' 'AFAM' 'LHCG' 'HLS' 'CYH' 'LPNT' 'UHS' 'PMC' 'BKD' 'CSU' 'KND'

'SEM']

Medical-HMO/(1.0) | size: 10 | mean correl: 0.59

['HUM' 'CI' 'UNH' 'AET' 'ANTM' 'WCG' 'CNC' 'MOH' 'GTS' 'MGLN']

Medical-Drugs/AA/(0.5) | size: 6 | mean correl: 0.61

['BMY' 'MRK' 'PFE' 'LLY' 'ABT' 'JNJ']

Healthcare-Products/(0.39) | size: 41 | mean correl: 0.48

['ABC' 'CAH' 'MCK' 'ESRX' 'DVA' 'DGX' 'LH' 'OMI' 'XRAY' 'HSIC' 'PDCO'

'WOOF' 'CHE' 'MD' 'BAX' 'MDT' 'SYK' 'ZBH' 'BCR' 'BDX' 'ISRG' 'BSX' 'HOLX'

'HRC' 'VAR' 'EW' 'RMD' 'BRKR' 'MTD' 'TMO' 'WAT' 'A' 'PKI' 'ALGN' 'COO'

'CRL' 'PRXL' 'QGEN' 'IDXX' 'BIO' 'TECH']

Oil&Gas Services/(0.76) | size: 35 | mean correl: 0.57

['SDRL' 'ATW' 'DO' 'RIG' 'PKD' 'BAS' 'KEG' 'RES' 'PES' 'UNT' 'HP' 'PTEN'

'SLB' 'BHI' 'HAL' 'FTI' 'NOV' 'DRQ' 'OII' 'OIS' 'SPN' 'CRR' 'BRS' 'CKH'

'HOS' 'TDW' 'MTRX' 'MDR' 'TESO' 'NR' 'HLX' 'TTI' 'WG' 'GEOS' 'IO']

Oil Comp-Explor&Prodtn/(0.85) | size: 49 | mean correl: 0.55

['NBL' 'APC' 'APA' 'DVN' 'OXY' 'COP' 'MRO' 'HES' 'MUR' 'PDCE' 'XEC' 'CXO'

'EOG' 'PXD' 'EGN' 'NFX' 'BP' 'CVX' 'XOM' 'INT' 'OKE' 'WMB' 'COG' 'EQT'

'RRC' 'CHK' 'GPOR' 'EGY' 'HK' 'GST' 'CLNE' 'REN' 'REXX' 'XCO' 'PQ' 'NOG'

'CRK' 'SGY' 'WTI' 'BBG' 'DNR' 'SM' 'CRZO' 'CLR' 'WLL' 'AXAS' 'CPE' 'AREX'

'MCF']

Insurance/(0.52) | size: 28 | mean correl: 0.54

['AWH' 'VR' 'ACGL' 'RE' 'RNR' 'AHL' 'AXS' 'WTM' 'AON' 'MMC' 'AJG' 'BRO'

'AFSI' 'XL' 'PGR' 'ALL' 'CB' 'CINF' 'MCY' 'ORI' 'PRA' 'THG' 'AFG' 'WRB'

'MKL' 'Y' 'ANAT' 'ERIE']

Super-Regional Banks-US/(0.53) | size: 25 | mean correl: 0.70

['SNV' 'MTB' 'PNC' 'BBT' 'USB' 'WFC' 'FHN' 'CMA' 'ZION' 'RF' 'HBAN' 'STI'

'FITB' 'KEY' 'COF' 'AXP' 'DFS' 'STT' 'BK' 'NTRS' 'GS' 'MS' 'C' 'BAC' 'JPM']

Diversified Finan Serv/(0.52) | size: 43 | mean correl: 0.59

['BLK' 'EV' 'BEN' 'TROW' 'AMG' 'AMP' 'IVZ' 'LM' 'WDR' 'FII' 'SEIC' 'CNS'

'VRTS' 'LAZ' 'EVR' 'GHL' 'ITG' 'IBKR' 'PJC' 'RJF' 'SF' 'ETFC' 'AMTD'

'SCHW' 'NDAQ' 'CME' 'ICE' 'BRK_A' 'BRK_B' 'AFL' 'HIG' 'LNC' 'MET' 'PRU'

'PFG' 'TMK' 'UNM' 'AIZ' 'RGA' 'AIG' 'LUK' 'CNA' 'L']

Banks/(0.48) | size: 71 | mean correl: 0.65

['CPF' 'HAFC' 'BANR' 'UCBI' 'FBP' 'BPOP' 'OFG' 'TBBK' 'NFBK' 'ORIT' 'FRME'

'PFS' 'INDB' 'FFBC' 'UBSI' 'FFIN' 'FNB' 'CBU' 'NBTB' 'IBOC' 'TRMK' 'WSBC'

'CHCO' 'STBA' 'CHFC' 'PRK' 'FFIC' 'BRKL' 'DCOM' 'BHLB' 'ISBC' 'OZRK'

'HOMB' 'PNFP' 'WAL' 'BPFH' 'PACW' 'COLB' 'UMBF' 'ONB' 'UMPQ' 'CVBF' 'GBCI'

'WABC' 'WTFC' 'BXS' 'FCF' 'FMBI' 'MBFI' 'TCBI' 'IBKC' 'HBHC' 'BOKF' 'CFR'

'PB' 'SBNY' 'VLY' 'FULT' 'BOH' 'CBSH' 'SIVB' 'CATY' 'EWBC' 'WBS' 'AF'

'NYCB' 'PBCT' 'NWBI' 'WAFD' 'CFFN' 'TFSL']

Insurance/(0.36) | size: 28 | mean correl: 0.48

['OB' 'ESGR' 'GLRE' 'MHLD' 'UFCS' 'IPCC' 'SAFT' 'AGII' 'NAVG' 'RLI' 'SIGI'

'AMSF' 'EIG' 'BOFI' 'UVE' 'BLX' 'OPY' 'FCNCA' 'HTH' 'HMN' 'KMPR' 'FFG'

'AEL' 'CNO' 'PZN' 'MKTX' 'BGCP' 'SFE']

S&L/Thrifts-Central US/(0.18) | size: 13 | mean correl: 0.36

['NICK' 'BANC' 'FBC' 'PSTB' 'SBCF' 'HTBK' 'SNBC' 'CNOB' 'FDEF' 'CHFN' 'CCF'

'EBTC' 'IHC']

Banks/(0.45) | size: 78 | mean correl: 0.51

['BMTC' 'FISI' 'WSFS' 'PCBK' 'EFSC' 'HFWA' 'ABCB' 'WTBA' 'BUSE' 'TOWN'

'SBSI' 'FBNC' 'AROW' 'GABC' 'GSBC' 'HTLF' 'UVSP' 'FCBC' 'LBAI' 'TCBK'

'STL' 'UBSH' 'TMP' 'BANF' 'SRCE' 'THFF' 'TRST' 'LKFN' 'SASR' 'SFNC' 'RNST'

'WASH' 'CTBI' 'SYBT' 'CAC' 'MSFG' 'BKMU' 'PEBO' 'UBNK' 'CSFL' 'EGBN'

'COBZ' 'FLIC' 'BSRR' 'OCFC' 'OKSB' 'RBCAA' 'ESSA' 'CSBK' 'EBSB' 'BNCL'

'KRNY' 'SENEA' 'NUTR' 'ODC' 'DGICA' 'HALL' 'EMCI' 'GBLI' 'STFC' 'CTO'

'CIA' 'NHC' 'CASS' 'WEYS' 'TBNK' 'BFIN' 'CZNC' 'BDGE' 'CCNE' 'FNLC' 'ATLO'

'BWINB' 'CCBG' 'PWOD' 'CNBKA' 'BMRC' 'NKSH']

Investment Companies/(0.96) | size: 14 | mean correl: 0.48

['HTGC' 'MAIN' 'TCAP' 'TICC' 'PNNT' 'PSEC' 'AINV' 'ARCC' 'BKCC' 'FSC'

'CSWC' 'MVC' 'GAIN' 'GLAD']

Internet/(0.09) | size: 44 | mean correl: 0.25

['JAKK' 'WWE' 'FLWS' 'AVHI' 'TTGT' 'ENZ' 'OME' 'DMRC' 'SNMX' 'ARAY' 'ARQL'

'LWAY' 'ISRL' 'ATRI' 'NVEC' 'OFLX' 'USLM' 'HBIO' 'RTIX' 'CWCO' 'KMG'

'PRSC' 'CFI' 'HCKT' 'PLUS' 'WINA' 'NATR' 'JOUT' 'ALCO' 'LMNR' 'HNRG' 'AIQ'

'RDNT' 'HNH' 'PLPC' 'SGA' 'BDE' 'NMRX' 'SHLO' 'BREW' 'SAM' 'MPAA' 'ATRC'

'HSTM']

Electronic Compo-Semicon/(0.11) | size: 46 | mean correl: 0.23

['CFNB' 'GRIF' 'GSIT' 'RELL' 'LINC' 'IVAC' 'QTM' 'MOSY' 'RBCN' 'CLUB'

'ATEC' 'AVNW' 'CVO' 'AHC' 'MNI' 'PRGX' 'RST' 'DWSN' 'MIND' 'AOI' 'FVE'

'MSL' 'RTK' 'JMBA' 'PCO' 'FHCO' 'PTIE' 'CTG' 'GSOL' 'HIL' 'SEAC' 'LUB'

'RSYS' 'CTIC' 'PPHM' 'BIOS' 'CPST' 'FCEL' 'XRM' 'UEC' 'URG' 'CYTX' 'VICL'

'HDNG' 'GMO' 'SPRT']

Water/(0.38) | size: 27 | mean correl: 0.40

['ARTNA' 'YORW' 'CTWS' 'MSEX' 'SJW' 'AWR' 'CWT' 'IDT' 'CBB' 'CNSL' 'GNCMA'

'ATNI' 'SHEN' 'CALM' 'CORE' 'CVGW' 'BGS' 'THS' 'WDFC' 'LNCE' 'JJSF' 'LANC'

'TR' 'JBSS' 'FARM' 'COKE' 'FIZZ']

Schools/(0.95) | size: 9 | mean correl: 0.49

['LRN' 'BPI' 'CECO' 'CPLA' 'STRA' 'APEI' 'LOPE' 'GHC' 'UTI']

Commercial Services/(0.31) | size: 69 | mean correl: 0.44

['HAIN' 'VRSK' 'ABCO' 'INWK' 'MED' 'NTRI' 'CHDN' 'ISCA' 'TRK' 'MTN' 'HELE'

'HSNI' 'NCMI' 'RGS' 'CENTA' 'PBH' 'UHAL' 'VRTU' 'EXLS' 'MMS' 'SYNT' 'CSGS'

'CVG' 'SYKE' 'TTEC' 'PRFT' 'LYV' 'CSGP' 'JCOM' 'LDOS' 'CACI' 'MANT' 'HCSG'

'CTAS' 'UNF' 'ABM' 'ROL' 'ACXM' 'HI' 'BCO' 'SCI' 'SSP' 'MDP' 'NYT' 'RRD'

'JW_A' 'SCHL' 'RECN' 'HSII' 'KFY' 'ASGN' 'DLX' 'KFRC' 'MAN' 'RHI' 'KELYA'

'TBI' 'FCN' 'HURN' 'TILE' 'KNL' 'SCS' 'HNI' 'MLHR' 'VOXX' 'NSR' 'OSIS'

'IRBT' 'UEIC']

Industrial/(0.17) | size: 106 | mean correl: 0.39

['ERII' 'STRL' 'GLDD' 'ORN' 'LTS' 'COWN' 'ATRO' 'INTL' 'AGM' 'BBSI' 'CWST'

'CRMT' 'MG' 'CMTL' 'RNWK' 'ETM' 'PKOH' 'MYRG' 'GHM' 'TISI' 'CLH' 'ECOL'

'HURC' 'NNBR' 'SEB' 'SP' 'AMSWA' 'TYPE' 'MRLN' 'LBY' 'LCUT' 'CRD_B' 'KVHI'

'AGYS' 'CRAI' 'LABL' 'ICFI' 'FC' 'GPX' 'VICR' 'CDI' 'LYTS' 'HZO' 'LDL'

'ELY' 'SPAR' 'FORR' 'TRC' 'ARC' 'SYX' 'HHS' 'MPX' 'CCRN' 'MLR' 'NWLI' 'NC'

'WMAR' 'MCRI' 'HVT' 'NPK' 'MTSC' 'RAVN' 'DEL' 'FIX' 'BRC' 'MATW' 'EXPO'

'NCI' 'MYE' 'MCS' 'NSP' 'BELFB' 'BBOX' 'DAKT' 'AAON' 'MEI' 'FSS' 'ROG'

'CTS' 'PKE' 'LNDC' 'ACET' 'CSS' 'DHIL' 'IIIN' 'EBF' 'VVI' 'GBL' 'WHG'

'NEWS' 'PICO' 'UFI' 'MLNK' 'EXTR' 'VDSI' 'DCO' 'VSEC' 'CBZ' 'DGII' 'DSPG'

'ESIO' 'KOPN' 'COHU' 'IXYS' 'MRCY' 'XOXO']

Chemicals/(0.29) | size: 65 | mean correl: 0.51

['AZZ' 'POWL' 'AIMC' 'WIRE' 'AIN' 'BDC' 'ENS' 'NPO' 'CIR' 'SNHY' 'ASTE'

'EME' 'MLI' 'B' 'WTS' 'AIT' 'KAMN' 'MSA' 'FELE' 'ROLL' 'TTEK' 'BGG' 'ESE'

'CMCO' 'KAI' 'JBT' 'TNC' 'SXI' 'BMI' 'GRC' 'NNI' 'MOD' 'SUP' 'AYR' 'RUSHA'

'TRS' 'MGRC' 'MINI' 'DORM' 'SMP' 'ALG' 'ATSG' 'SRI' 'ACCO' 'MWA' 'AVD'

'FOE' 'SCL' 'SHLM' 'KWR' 'POL' 'FUL' 'MTX' 'SXT' 'OLN' 'KOP' 'TG' 'IPHS'

'HWKN' 'IOSP' 'OMN' 'ANDE' 'CCC' 'DAR' 'LXU']

Finance-Consumer Loans/(0.18) | size: 28 | mean correl: 0.37

['EPM' 'NGS' 'PHX' 'GIFI' 'HWCC' 'USAP' 'LAYN' 'AP' 'BOOM' 'CVGI' 'TWIN'

'ASCMA' 'NWPX' 'FSTR' 'PHIIK' 'EZPW' 'FCFS' 'WRLD' 'ECPG' 'PRAA' 'DDD'

'SSYS' 'AMSC' 'MCHX' 'ENOC' 'SPWR' 'CVA' 'ORA']

Retail-Restaurants/(0.91) | size: 25 | mean correl: 0.45

['MCD' 'SBUX' 'YUM' 'CMG' 'PNRA' 'TAST' 'BH' 'DENN' 'RUTH' 'DRI' 'EAT'

'CBRL' 'CAKE' 'TXRH' 'BOBE' 'DIN' 'RT' 'BJRI' 'BWLD' 'DPZ' 'PZZA' 'WEN'

'RRGB' 'JACK' 'SONC']

Food-Retail/(0.86) | size: 8 | mean correl: 0.48

['SVU' 'KR' 'WFM' 'VLGEA' 'IMKTA' 'WMK' 'SPTN' 'UNFI']

Retail-Apparel/Shoe/(0.3) | size: 21 | mean correl: 0.33

['DEST' 'DXLG' 'BGFV' 'SCVL' 'SMRT' 'SSI' 'PSMT' 'MNRO' 'CASY' 'FRED' 'BKS'

'CTRN' 'KIRK' 'TUES' 'BBW' 'CONN' 'BONT' 'CBK' 'NWY' 'BEBE' 'RGR']

Apparel/(0.78) | size: 18 | mean correl: 0.52

['COH' 'VFC' 'PVH' 'RL' 'HBI' 'NKE' 'UAA' 'SKX' 'CROX' 'DECK' 'SHOO' 'WWW'

'MOV' 'PERY' 'ICON' 'GIII' 'COLM' 'OXM']

Retail-Discount/(0.53) | size: 10 | mean correl: 0.50

['AAP' 'AZO' 'ORLY' 'TGT' 'COST' 'WMT' 'ROST' 'TJX' 'BIG' 'DLTR']

Retail-Apparel/Shoe/(0.44) | size: 38 | mean correl: 0.46

['ODP' 'SPLS' 'BBY' 'GME' 'AAN' 'RCII' 'PIR' 'BBBY' 'WSM' 'SBH' 'TSCO'

'ULTA' 'VSI' 'CAB' 'DKS' 'HIBB' 'FINL' 'FL' 'CRI' 'PLCE' 'GPS' 'LB' 'AEO'

'ANF' 'GES' 'ZUMZ' 'DSW' 'ASNA' 'CHS' 'BKE' 'CATO' 'GCO' 'SHLD' 'JCP'

'KSS' 'DDS' 'JWN' 'M']

Semiconductors/(0.83) | size: 48 | mean correl: 0.50

['AMD' 'MU' 'MRVL' 'NVDA' 'AMKR' 'KLAC' 'LRCX' 'AMAT' 'TER' 'CRUS' 'AVGO'

'SWKS' 'MXIM' 'XLNX' 'MCHP' 'ADI' 'TXN' 'CAVM' 'CY' 'DIOD' 'IDTI' 'MSCC'

'SLAB' 'SMTC' 'MPWR' 'POWI' 'PLAB' 'CCMP' 'AEIS' 'BRKS' 'ENTG' 'MKSI'

'UCTT' 'NANO' 'RTEC' 'ACLS' 'PDFS' 'SIGM' 'IMMR' 'SYNA' 'KEM' 'CEVA'

'CREE' 'VECO' 'FORM' 'RMBS' 'LSCC' 'XCRA']

Software/(0.37) | size: 43 | mean correl: 0.45

['TTWO' 'ATVI' 'EA' 'NFLX' 'BIDU' 'EXPE' 'GOOGL' 'AMZN' 'PCLN' 'AKAM'

'VRSN' 'CHKP' 'DOX' 'CVLT' 'VMW' 'CRM' 'CTXS' 'RHT' 'CDNS' 'SNPS' 'ADSK'

'ANSS' 'ADBE' 'INTU' 'AZPN' 'NUAN' 'STX' 'WDC' 'HPQ' 'XRX' 'CTSH' 'ACN'

'IBM' 'CSCO' 'INTC' 'SYMC' 'MSFT' 'CA' 'ORCL' 'AAPL' 'MSI' 'EBAY' 'QCOM']

Electronics/(0.4) | size: 63 | mean correl: 0.47

['OCLR' 'INFN' 'CIEN' 'FNSR' 'BRCD' 'NTAP' 'FFIV' 'JNPR' 'OLED' 'IPGP'

'COHR' 'IIVI' 'FARO' 'CGNX' 'LFUS' 'TTMI' 'JBL' 'SANM' 'BHE' 'PLXS' 'NSIT'

'SCSC' 'SNX' 'TECD' 'ARW' 'AVT' 'AVX' 'VSH' 'GRMN' 'ITRI' 'NATI' 'TRMB'

'FLIR' 'HRS' 'GLW' 'APH' 'TEL' 'SONS' 'SNCR' 'HLIT' 'NTCT' 'DLB' 'IDCC'

'ADTN' 'ARRS' 'VSAT' 'NTGR' 'PLT' 'DHX' 'MXWL' 'CRAY' 'SMCI' 'DBD' 'NCR'

'PAY' 'UIS' 'ZBRA' 'BID' 'EFII' 'WEX' 'DGI' 'LORL' 'SATS']

Software/(0.35) | size: 56 | mean correl: 0.33

['CPSI' 'QSII' 'ATHN' 'CERN' 'MDRX' 'IRDM' 'ORBC' 'CCOI' 'LVLT' 'EGHT' 'VG'

'CLFD' 'QUIK' 'CAMP' 'WBMD' 'VRNT' 'PEGA' 'MSTR' 'MANH' 'TYL' 'ULTI'

'EGOV' 'EPAY' 'PRGS' 'ACIW' 'BLKB' 'CALD' 'GUID' 'MDSO' 'LOGM' 'PRO'

'STMP' 'OSTK' 'SHOR' 'EHTH' 'PETS' 'LQDT' 'CATM' 'BCOR' 'LPSN' 'EBIX'

'MGI' 'INAP' 'LLNW' 'CACC' 'ACTG' 'HMSY' 'WTW' 'SIRI' 'CETV' 'KTOS' 'VHC'

'SFLY' 'ZIXI' 'TIVO' 'TZOO']

Diversified Manufact Op/(0.34) | size: 41 | mean correl: 0.62

['UNP' 'CSX' 'NSC' 'GWR' 'KSU' 'MSM' 'FAST' 'GWW' 'JCI' 'GE' 'DHR' 'HON'

'UTX' 'ITW' 'MMM' 'PCAR' 'CAT' 'CMI' 'IR' 'ETN' 'PH' 'EMR' 'ROK' 'WAB'

'AME' 'ROP' 'CFX' 'PNR' 'ITT' 'CR' 'DOV' 'FLS' 'RBC' 'ATU' 'KMT' 'TKR'

'NDSN' 'GGG' 'IEX' 'DCI' 'LECO']

Engineering&Construction/(0.36) | size: 44 | mean correl: 0.50

['ACM' 'CBI' 'KBR' 'FLR' 'JEC' 'DY' 'MTZ' 'PWR' 'AGX' 'PRIM' 'NCS' 'FOR'

'BECN' 'AEGN' 'GVA' 'TPC' 'TITN' 'AGCO' 'DE' 'LNN' 'VMI' 'RAIL' 'ARII'

'GBX' 'TRN' 'CAR' 'HTZ' 'OSK' 'MTW' 'TEX' 'WNC' 'NAV' 'MTOR' 'WBC' 'TGH'

'HEES' 'URI' 'GTLS' 'TWI' 'DXPE' 'AXE' 'WCC' 'BGC' 'HSC']

Packaging&Containers/(0.67) | size: 18 | mean correl: 0.54

['GPK' 'ATR' 'BMS' 'SON' 'AVY' 'SEE' 'GEF' 'SLGN' 'BLL' 'CCK' 'UFS' 'KS'

'IP' 'PKG' 'SWM' 'CLW' 'GLT' 'NP']

Chemicals/(0.62) | size: 23 | mean correl: 0.56

['IPI' 'CF' 'MOS' 'DD' 'DOW' 'HUN' 'CBT' 'FMC' 'CE' 'EMN' 'WLK' 'APD' 'PX'

'IFF' 'ECL' 'PPG' 'RPM' 'NEU' 'ASH' 'ALB' 'GRA' 'CMP' 'MON']

Iron/Steel/(0.6) | size: 19 | mean correl: 0.60

['CLF' 'AKS' 'X' 'ZEUS' 'SCHN' 'CMC' 'RS' 'NUE' 'STLD' 'CRS' 'WOR' 'FCX'

'SCCO' 'ARNC' 'CENX' 'GSM' 'KALU' 'HAYN' 'MTRN']

Oil Refining&Marketing/(0.8) | size: 6 | mean correl: 0.70

['HFC' 'TSO' 'VLO' 'CVI' 'ALJ' 'DK']

Transport-Marine/(0.62) | size: 19 | mean correl: 0.34

['NNA' 'DHT' 'FRO' 'NAT' 'TNK' 'PEIX' 'GPRE' 'REX' 'NM' 'SB' 'WLB' 'GLNG'

'SFL' 'TK' 'FTK' 'LNG' 'MNTX' 'KRO' 'NL']

Airlines/(0.95) | size: 9 | mean correl: 0.63

['AAL' 'DAL' 'UAL' 'JBLU' 'ALK' 'LUV' 'ALGT' 'HA' 'SKYW']

Transport-Truck/(0.74) | size: 23 | mean correl: 0.51

['HTLD' 'KNX' 'WERN' 'ODFL' 'JBHT' 'LSTR' 'ARCB' 'SAIA' 'CGI' 'MRTN' 'KEX'

'MATX' 'FDX' 'UPS' 'CHRW' 'EXPD' 'AAWW' 'FWRD' 'HUBG' 'ECHO' 'XPO' 'USAK'

'YRCW']

Aerospace/Defense/(0.72) | size: 20 | mean correl: 0.56

['LMT' 'NOC' 'RTN' 'GD' 'LLL' 'SPR' 'BA' 'COL' 'HXL' 'TXT' 'TDG' 'TGI'

'AVAV' 'CUB' 'ESL' 'MOG_A' 'CW' 'TDY' 'AIR' 'HEI']

Media/(0.63) | size: 19 | mean correl: 0.46

['CMLS' 'EVC' 'GTN' 'NXST' 'SBGI' 'CNK' 'RGC' 'SNI' 'DISCA' 'DISCK' 'DIS'

'FOX' 'FOXA' 'TWX' 'CBS' 'VIAB' 'DISH' 'CMCSA' 'LBTYA']

Cellular Telecom/(0.5) | size: 11 | mean correl: 0.46

['SBAC' 'AMT' 'CCI' 'VOD' 'CTL' 'T' 'VZ' 'TDS' 'USM' 'S' 'TMUS']

Commercial Serv-Finance/(0.23) | size: 62 | mean correl: 0.42

['HRG' 'SPB' 'HLF' 'NUS' 'USNA' 'IPAR' 'REV' 'ADM' 'BG' 'FDP' 'INGR' 'CCL'

'RCL' 'CHH' 'MAR' 'WYN' 'IRM' 'LAMR' 'IPG' 'OMC' 'EL' 'TRI' 'SMG' 'NWL'

'TUP' 'CCO' 'CPA' 'STC' 'CLGX' 'FNF' 'ALR' 'HRB' 'RAD' 'CVS' 'WBA' 'SRCL'

'WCN' 'RSG' 'WM' 'MA' 'V' 'MORN' 'MCO' 'FDS' 'MSCI' 'EFX' 'FICO' 'IT' 'BR'

'DST' 'EEFT' 'MIDD' 'G' 'ADP' 'PAYX' 'FIS' 'FISV' 'JKHY' 'ADS' 'WU' 'GPN'

'TSS']

Bldg-Residential/Commer/(0.92) | size: 11 | mean correl: 0.73

['NVR' 'MHO' 'PHM' 'TOL' 'DHI' 'LEN' 'KBH' 'MDC' 'MTH' 'BZH' 'HOV']

Retail-Automobile/(0.54) | size: 16 | mean correl: 0.58

['KMX' 'AN' 'LAD' 'ABG' 'SAH' 'GPI' 'PAG' 'CTB' 'GT' 'THRM' 'F' 'GNTX'

'AXL' 'BWA' 'DAN' 'TEN']

Building Materials/(0.45) | size: 50 | mean correl: 0.49

['TREX' 'AMWD' 'BLDR' 'CVCO' 'APOG' 'ROCK' 'NX' 'GFF' 'SSD' 'UFPI' 'EXP'

'MLM' 'VMC' 'LPX' 'OC' 'USG' 'AWI' 'MAS' 'MHK' 'SHW' 'HD' 'LOW' 'CPRT'

'POOL' 'GPC' 'LKQ' 'WSO' 'AOS' 'LII' 'AYI' 'TTC' 'CSL' 'SNA' 'SWK' 'SCSS'

'TPX' 'ETH' 'LZB' 'LEG' 'WHR' 'HAS' 'MAT' 'HOG' 'BC' 'PII' 'SIG' 'TIF'

'LL' 'THO' 'WGO']

REITS-Hotels/(0.64) | size: 19 | mean correl: 0.53

['AHT' 'FCH' 'RHP' 'HT' 'HPT' 'SHO' 'HST' 'DRH' 'LHO' 'CXW' 'GEO' 'WY'

'PCH' 'RYN' 'JOE' 'CBG' 'JLL' 'HF' 'KW']

Casino Hotels/(0.62) | size: 8 | mean correl: 0.56

['MGM' 'LVS' 'WYNN' 'PENN' 'BYD' 'PNK' 'IGT' 'SGMS']

Financial Guarantee Ins/(0.67) | size: 8 | mean correl: 0.45

['MTG' 'RDN' 'AGO' 'MBI' 'ASPS' 'OCN' 'PHH' 'WAC']