[paper] Assisting in Writing Wikipedia-like Articles From Scratch with Large Language Models

[paper] Assisting in Writing Wikipedia-like Articles From Scratch with Large Language Models

Summary of the paper

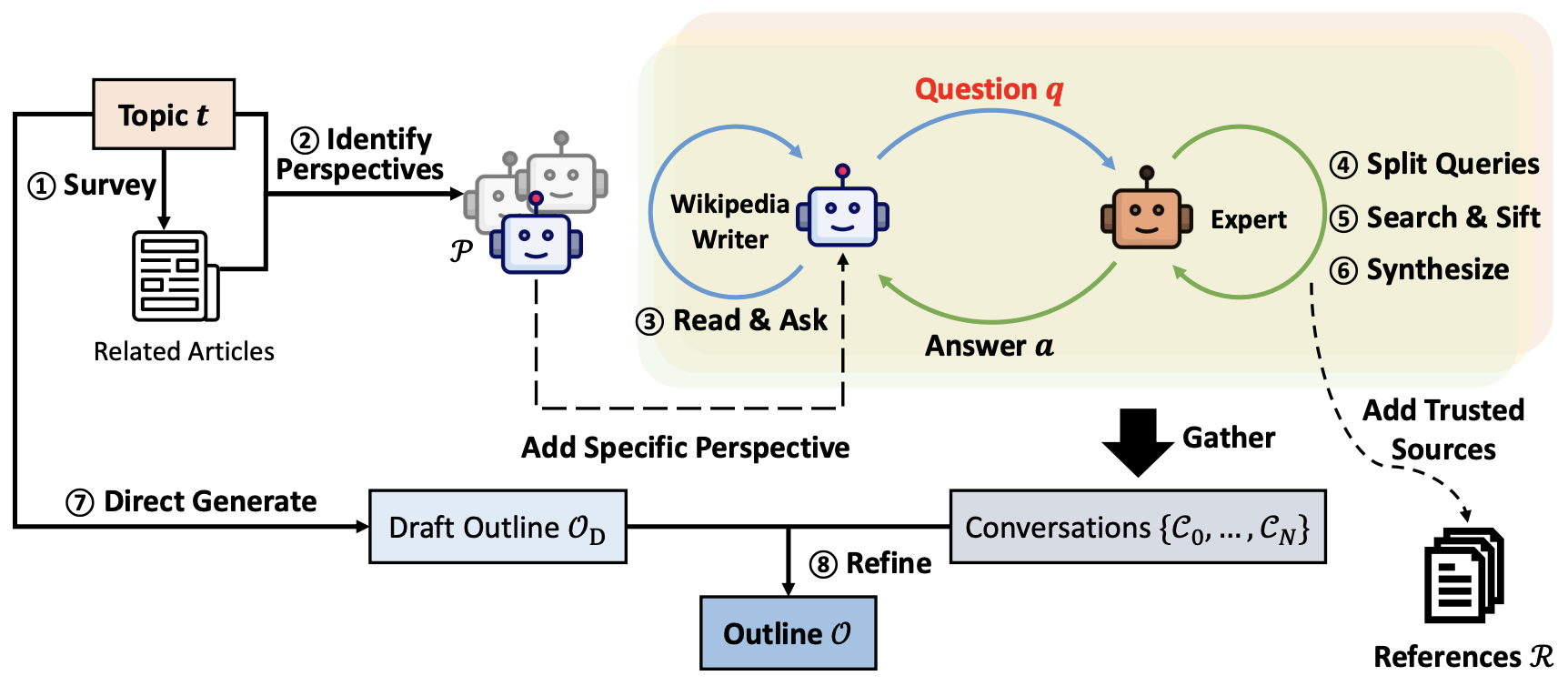

The paper introduces STORM, a framework designed to help large language models (LLMs) create Wikipedia-like articles from scratch by focusing on a structured pre-writing phase. STORM’s core method involves synthesizing topic outlines through a unique process of perspective-guided question asking and multi-turn simulated conversations. These steps allow the LLM to gather information from diverse viewpoints, leading to comprehensive and organized outlines. Using these outlines, STORM generates well-structured articles with improved depth, coherence, and factual accuracy. The framework outperforms traditional retrieval-augmented approaches, though challenges like source bias and verifiability remain areas for future refinement.

Q&A with ChatGPT against the paper

Q: What are they key elements in the paper’s method to generate a high quality article?

A: The key elements of the method in the paper for generating high-quality Wikipedia-like articles involve the STORM framework, which structures the pre-writing process into several steps:

- Perspective-Guided Question Asking: STORM starts by identifying multiple perspectives on a topic, helping generate diverse and in-depth questions that guide research effectively.

- Simulated Conversations: By simulating a conversation between a topic expert and a Wikipedia writer, the model iteratively refines its understanding of the topic, asking follow-up questions to gather comprehensive information.

- Outline Creation: The gathered information is organized into an outline using the model’s internal knowledge and curated sources. This outline serves as a structured foundation for the article.

- Section-by-Section Writing: Each section of the article is generated based on the outline and relevant sources, ensuring coherence, coverage, and citation accuracy.

Q: How does STORM identify the multiple perspectives on a given topic?

A: STORM identifies multiple perspectives on a given topic by first surveying related Wikipedia articles. It retrieves the tables of contents from these articles to help pinpoint diverse viewpoints relevant to the topic. These perspectives, such as those of experts or laypeople, are then used to guide the generation of varied and specific questions. This approach ensures that the model gathers a broad, nuanced understanding of the topic, allowing it to explore and integrate different facets into the final article outline.

Q: What kind of framework is used in order to simulate the conversations?

A: STORM uses the DSPy framework to simulate conversations between a “Wikipedia writer” and a “topic expert.” This framework enables multi-turn, information-seeking dialogues, allowing the model to iteratively pose questions and gather responses. Each question-answer cycle builds on previous interactions, enhancing the depth and relevance of the information collected. Trusted online sources are incorporated to ground responses in verified data, supporting a reliable foundation for the final article outline and content generation.

Q: What are the weaknesses of this paper?

A: Some weaknesses in the paper include:

- Bias and Verifiability Issues: STORM may inadvertently transfer biases from its information sources, leading to articles that sometimes lack neutrality or include unverifiable connections between facts.

- Citation Limitations: Though citations are used, some generated connections between information pieces are not directly verifiable, raising accuracy concerns.

- Simplified Task Scope: The framework primarily generates text-based articles, overlooking multimedia or structured data (like tables) typical of high-quality Wikipedia entries, which limits its realism for broader applications.

Q: Besides the Wikipedia use case, what could be other interesting and relevant tasks that this STORM framework could tackle?

A: Beyond Wikipedia, the STORM framework could be applied to other tasks requiring comprehensive research, structure, and neutrality, such as:

- Educational Content Creation: Developing curricula, study guides, or academic summaries where balanced perspectives are essential.

- Technical Documentation: Producing structured and informative guides, FAQs, or manuals for complex systems in software or engineering.

- Market Analysis Reports: Compiling structured business or financial reports with varied perspectives (e.g., market trends, consumer insights, regulatory impacts).

- Policy Briefs: Crafting policy documents that balance diverse viewpoints, ensuring well-rounded insights for government or NGO reports.

These tasks would benefit from STORM’s capacity to integrate varied information sources, generate outlines, and maintain organized content.

Q: What kind of questions would you suggest to ask against this paper to learn as much as possible from this paper?

A: Here are some in-depth questions to guide your learning from the paper:

Framework Design: What motivated the choice of using the DSPy framework for conversation simulation, and how does it enhance the pre-writing stage? Evaluation Metrics: How do the paper’s automatic and human evaluation metrics assess outline quality? What are their limitations? Perspective Discovery: What methods did the authors explore for identifying diverse perspectives, and could alternative approaches improve this process? Bias Handling: How does the framework address potential biases in information retrieval, and what solutions are suggested for future work? Applications Beyond Wikipedia: What specific adaptations might be necessary to apply STORM in fields like policy analysis or technical documentation?

Q: What kind of experiments do the author perform with their ablation study?

A: In their ablation study, the authors evaluate the impact of different components within the STORM framework on the quality of generated Wikipedia-like articles. They systematically remove or modify specific elements to assess their contributions:

- Perspective-Guided Question Asking: They examine the effect of generating questions from multiple perspectives versus a single perspective, analyzing how this influences the depth and breadth of the collected information.

- Simulated Conversations: The study assesses the role of multi-turn conversations between simulated roles (e.g., “Wikipedia writer” and “topic expert”) in enhancing the relevance and coherence of the gathered content.

- Outline Generation: They investigate the importance of structured outline creation prior to writing, comparing outcomes with and without this step to determine its impact on the organization and coverage of the final article.

Q: What’s the conclusion of this ablation study?

A: The study concludes that each component of the STORM framework plays a vital role in producing high-quality, well-structured Wikipedia-like articles. Removing any of these elements results in a noticeable decline in the overall quality of the generated content.

Related work

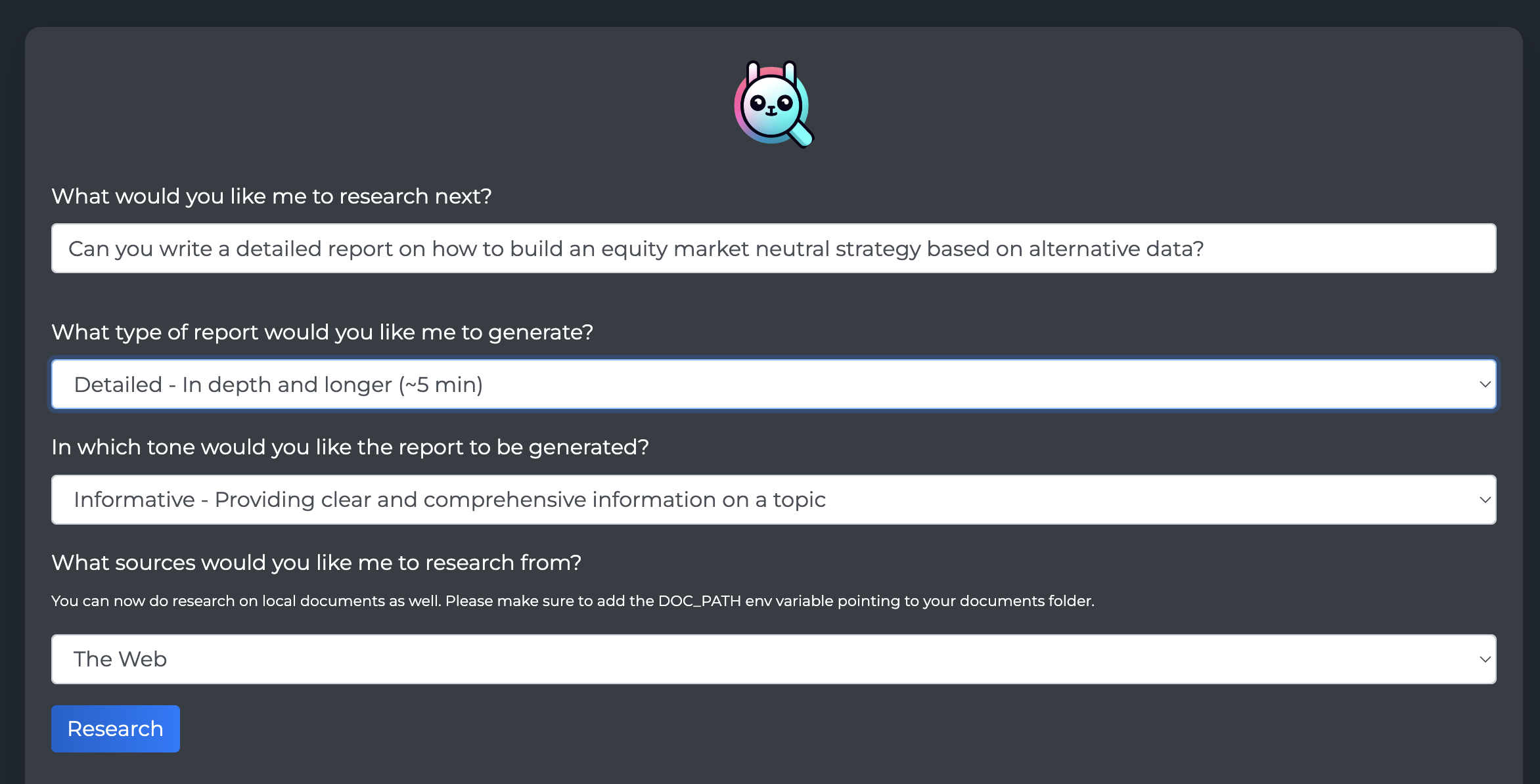

While exploring frameworks implementing similar ideas, I came across GPT Researcher and decided to give it a try. It’s straightforward to install locally, and you can start experimenting right away using the default configuration—assuming you have API keys for OpenAI and Tavily.

Setting up the experiment is as easy as this:

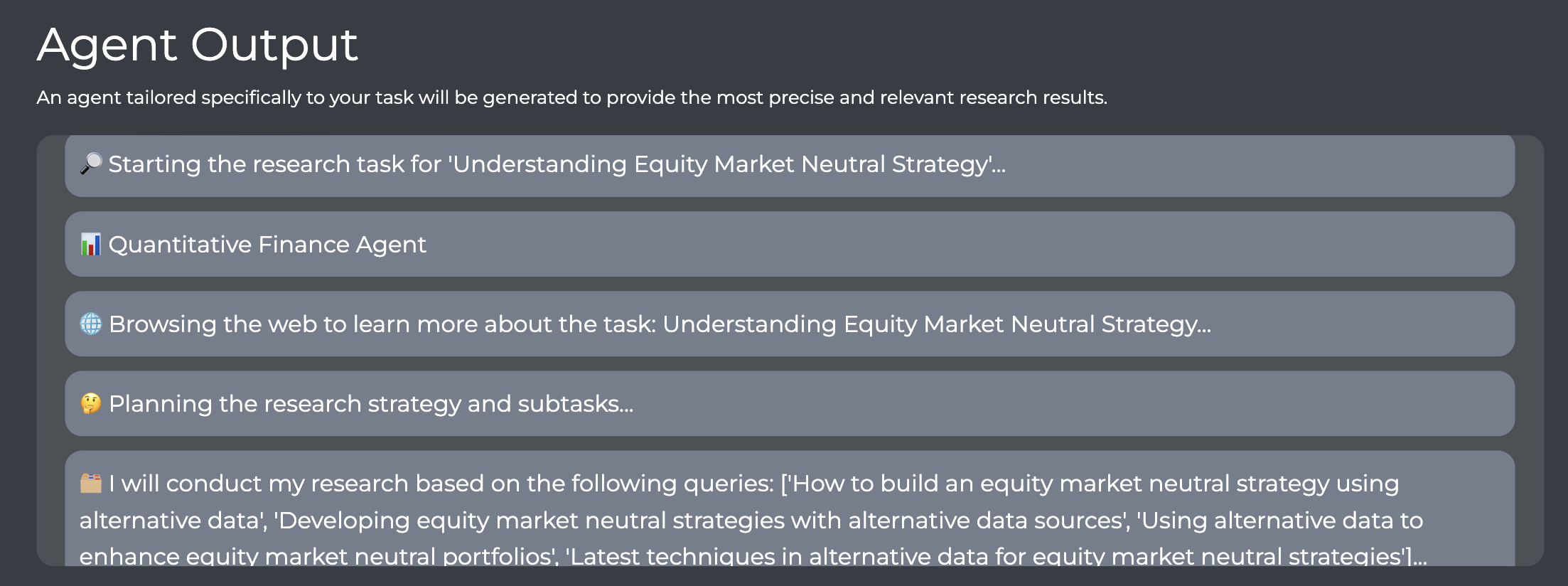

Wait for 5 minutes while the Agent is doing its thing…

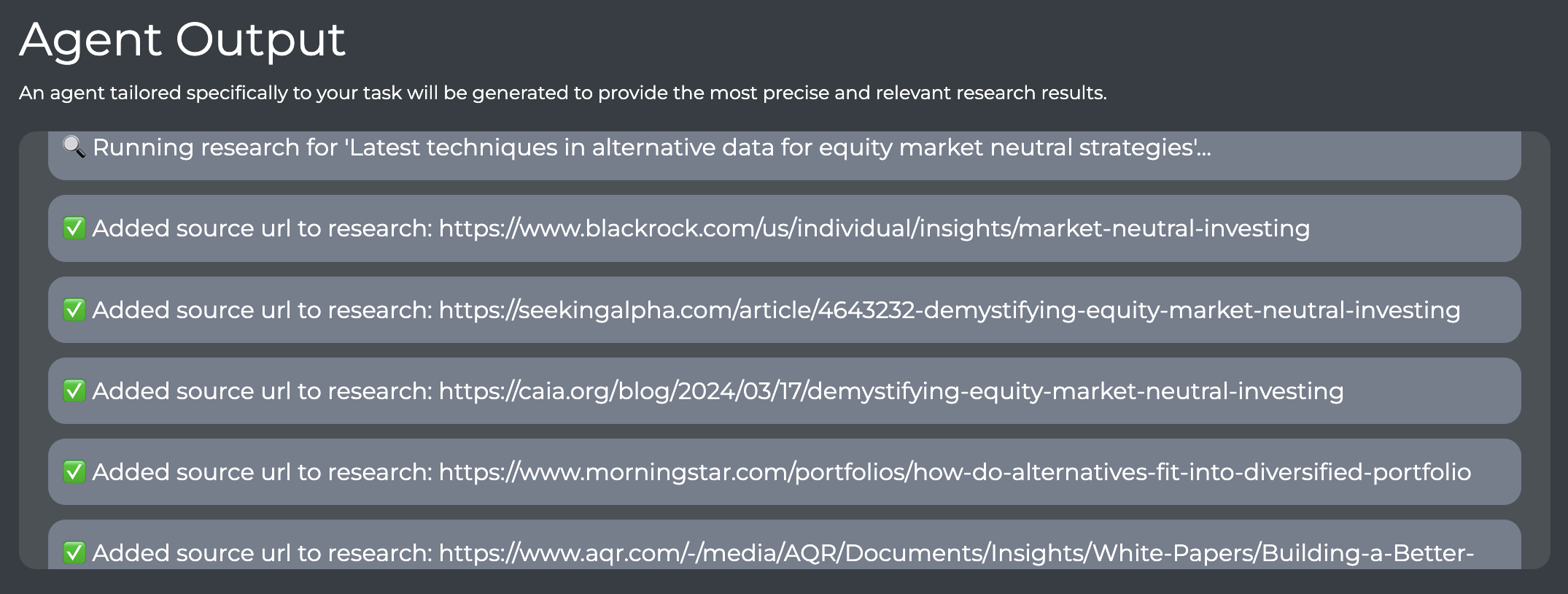

The results were somewhat disappointing (using only the web; not grounded in a relevant corpus). Not too surprising given the sources the Agent selected…

I’ll let you judge for yourself:

Agent Output:

Building an Equity Market Neutral Strategy Using Alternative Data

In the evolving landscape of quantitative finance, equity market neutral (EMN) strategies have emerged as a robust approach to achieving returns independent of market direction. These strategies, primarily employed by hedge funds, involve taking offsetting long and short positions in closely related stocks to hedge against market exposure. This approach seeks to capitalize on price discrepancies while maintaining a balanced portfolio that is theoretically immune to market volatility. The advent of alternative data has further revolutionized this domain, offering new avenues for enhancing the precision and effectiveness of EMN strategies.

Equity market neutral strategies are designed to exploit differences in stock prices by maintaining an equal amount of long and short positions in stocks that share similar characteristics, such as market capitalization or sector affiliation. This strategy is particularly appealing to institutional investors seeking to outperform traditional bonds without the high risk associated with more aggressive funds. For a comprehensive understanding of EMN strategies, Investopedia provides a detailed overview of their mechanics and benefits.

The integration of alternative data into EMN strategies represents a significant advancement in portfolio management. Alternative data, which includes non-traditional sources such as social media sentiment, satellite imagery, and transaction data, offers a granular view of market dynamics that traditional data sources might overlook. This data can enhance the predictive accuracy of stock price movements, thereby refining the selection of long and short positions within an EMN framework. Studies, such as those published in MDPI, have demonstrated the efficacy of using machine learning models like LSTM for stock prediction, leveraging alternative data to construct market-neutral portfolios.

Moreover, the systematic application of alternative data in EMN strategies can help mitigate risks and enhance returns. By employing sophisticated algorithms and machine learning techniques, portfolio managers can dynamically adjust their positions to maintain market neutrality, even as market conditions fluctuate. This approach is supported by insights from BlackRock, which emphasizes the importance of a systematic process in capturing alpha opportunities and managing risk exposures.

In conclusion, building an equity market neutral strategy using alternative data involves a nuanced understanding of both traditional financial principles and cutting-edge data analytics. As the financial markets continue to evolve, the integration of alternative data into EMN strategies will likely become an essential component for investors seeking to achieve consistent returns in an increasingly complex market environment.

Understanding Equity Market Neutral Strategy

Equity Market Neutral (EMN) strategies are designed to exploit pricing inefficiencies while maintaining a neutral exposure to the overall market. This report explores how to build an EMN strategy using alternative data, focusing on the integration of machine learning models, data collection techniques, and risk management practices.

Leveraging Alternative Data in EMN Strategies

Alternative data refers to non-traditional data sources that can provide unique insights into market trends. These include social media sentiment, satellite imagery, and web traffic data. The use of alternative data in EMN strategies can enhance the predictive power of models and uncover alpha opportunities that traditional data might miss.

Data Collection and Processing

The first step in incorporating alternative data into an EMN strategy is data collection and processing. Hedge funds and investment firms gather a wide array of data, including financial statements, earnings reports, and alternative unstructured data like news articles and social media sentiment (Aurum). The data is then cleaned and structured to be fed into quantitative models.

Signal Generation

Once the data is processed, the next step is generating trading signals. Quantitative models analyze the data to identify patterns and predict future stock movements. For instance, a model might use natural language processing (NLP) to gauge sentiment from news articles, which can then be used to predict stock price movements (Aurum). This approach allows for the creation of signals based on value, growth, price momentum, and quality.

Machine Learning Models in EMN Strategies

Machine learning models, particularly Long Short-Term Memory (LSTM) networks, have gained popularity in EMN strategies due to their ability to handle time series data effectively. These models can predict stock prices and returns with high accuracy, which is crucial for constructing a market-neutral portfolio (MDPI).

LSTM-Based Stock Prediction

LSTM networks are particularly suited for stock prediction due to their ability to capture long-term dependencies in data. By training on historical stock prices and alternative data, LSTM models can forecast future price movements, aiding in the selection of stocks for long and short positions in an EMN strategy.

Portfolio Construction

The construction of a market-neutral portfolio involves balancing long and short positions to achieve a beta close to zero. This is typically done by selecting an equal number of stocks for both positions, ensuring that gains from one side offset losses from the other (MDPI). The use of LSTM models in this process can enhance the robustness of the portfolio by improving stock selection accuracy.

Risk Management in EMN Strategies

Risk management is a critical component of EMN strategies, as it ensures that the portfolio remains market-neutral and minimizes exposure to systematic risk. This involves continuous monitoring and rebalancing of positions to maintain the desired risk profile.

Hedging Techniques

One of the main advantages of EMN strategies is their ability to hedge against market risk. By taking long positions in stocks expected to outperform and short positions in those expected to underperform, the strategy can mitigate the impact of market volatility (Picton Mahoney).

Diversification Benefits

EMN strategies offer diversification benefits by providing returns that are independent of market direction. This can be particularly valuable in periods of high market volatility, where traditional portfolios may suffer significant losses. By incorporating alternative data and machine learning models, EMN strategies can further enhance diversification by uncovering unique alpha opportunities (BlackRock).

Performance Evaluation and Adjustment

Evaluating the performance of an EMN strategy involves analyzing its risk-adjusted returns and ensuring that it meets the desired investment objectives. This requires regular backtesting and adjustment of models and data inputs to adapt to changing market conditions.

Backtesting and Model Validation

Backtesting is a crucial step in validating the effectiveness of an EMN strategy. By simulating the strategy’s performance on historical data, investors can assess its potential returns and identify any weaknesses in the model. This process also involves adjusting the model parameters and data inputs to optimize performance (CAIA).

Continuous Improvement

The dynamic nature of financial markets necessitates continuous improvement of EMN strategies. This involves updating models with new data, incorporating additional alternative data sources, and refining trading algorithms to maintain a competitive edge. By staying abreast of technological advancements and market trends, investors can ensure that their EMN strategies remain effective and profitable (Class Central).

Integration with Traditional Investment Strategies

While EMN strategies offer unique benefits, they can also complement traditional investment strategies by providing additional diversification and risk mitigation.

Complementing the 60/40 Portfolio

The traditional 60/40 portfolio, which allocates 60% to equities and 40% to bonds, can benefit from the inclusion of EMN strategies. By providing returns that are uncorrelated with the broader market, EMN strategies can enhance the overall risk-adjusted returns of the portfolio and reduce its vulnerability to market downturns (CAIA).

Enhancing Long-Biased Portfolios

EMN strategies can also complement long-biased portfolios by offering a hedge against market declines. By balancing long and short positions, these strategies can mitigate the impact of market volatility and provide a more stable return profile (Picton Mahoney).

In summary, building an equity market-neutral strategy using alternative data involves integrating innovative data sources, advanced machine learning models, and robust risk management practices. By doing so, investors can create strategies that offer compelling returns and diversification benefits, even in challenging market conditions.

Utilizing Alternative Data in EMN Strategy Advanced Data Integration Techniques

While previous sections have covered the basics of data collection and processing, this section delves deeper into advanced techniques for integrating alternative data into Equity Market Neutral (EMN) strategies. Unlike traditional data sources, alternative data such as satellite imagery, social media sentiment, and web traffic data require sophisticated integration methods to be effectively utilized in quantitative models.

Data Fusion: This technique involves combining multiple data sources to create a comprehensive dataset that enhances the predictive power of EMN strategies. For example, integrating satellite imagery with social media sentiment can provide a more nuanced view of consumer behavior and market trends (AlphaSense). Natural Language Processing (NLP): NLP is used to analyze unstructured text data from news articles and social media posts. By extracting sentiment and key themes, NLP can generate valuable insights that inform trading decisions. This approach is particularly useful for capturing market sentiment shifts that may not be reflected in traditional financial metrics (Aurum). Geospatial Analysis: Utilizing geolocation data from smartphones and other devices can offer insights into foot traffic patterns and consumer behavior. This data can be particularly valuable for retail and consumer goods sectors, providing a real-time view of market dynamics (AlphaSense). Signal Enhancement through Machine Learning

While previous sections discussed LSTM-based stock prediction, this section focuses on enhancing signal generation through advanced machine learning techniques. These methods leverage alternative data to improve the accuracy and reliability of trading signals in EMN strategies.

Ensemble Learning: By combining predictions from multiple machine learning models, ensemble learning can enhance the robustness of trading signals. This approach mitigates the risk of overfitting and improves the generalization of models to new data (OptimizDBA). Feature Engineering: Advanced feature engineering techniques can extract meaningful patterns from alternative data, such as identifying correlations between social media sentiment and stock price movements. These engineered features can significantly enhance the predictive power of machine learning models (SSRN). Deep Reinforcement Learning: This technique involves training models to make sequential decisions by interacting with a simulated market environment. By learning from past actions and outcomes, reinforcement learning models can optimize trading strategies in dynamic market conditions (Academia.edu). Risk Management Innovations

While previous sections have covered traditional hedging techniques, this section explores innovative risk management strategies that leverage alternative data to enhance EMN strategies.

Dynamic Risk Assessment: By continuously monitoring alternative data sources, such as news sentiment and social media trends, investors can dynamically assess and adjust risk exposures. This proactive approach allows for timely responses to emerging risks and opportunities (BlackRock). Volatility Prediction: Using machine learning models to predict market volatility based on alternative data can help investors better manage risk. For instance, analyzing social media sentiment can provide early warnings of potential market disruptions, allowing for preemptive risk mitigation (MDPI). Scenario Analysis: By simulating various market scenarios using alternative data, investors can evaluate the potential impact of different risk factors on their portfolios. This approach enables more informed decision-making and enhances the resilience of EMN strategies (OptimizDBA). Portfolio Optimization with Alternative Data

While previous sections have discussed portfolio construction, this section focuses on optimizing EMN portfolios using alternative data to achieve superior risk-adjusted returns.

Multi-Objective Optimization: This technique involves optimizing portfolios based on multiple criteria, such as maximizing returns while minimizing risk. By incorporating alternative data, investors can identify non-traditional factors that contribute to portfolio performance, such as consumer sentiment and environmental trends (Aurum). Adaptive Rebalancing: Utilizing real-time alternative data allows for adaptive portfolio rebalancing, ensuring that portfolios remain aligned with current market conditions. This approach enhances the agility of EMN strategies and improves their ability to capture short-term market opportunities (Academia.edu). Factor Analysis: By analyzing alternative data, investors can identify new factors that drive stock returns, such as brand loyalty or supply chain disruptions. Incorporating these factors into portfolio optimization models can enhance the predictive accuracy and performance of EMN strategies (SSRN). Continuous Strategy Refinement

While previous sections have emphasized the importance of continuous improvement, this section highlights specific strategies for refining EMN strategies using alternative data.

Feedback Loops: Establishing feedback loops that incorporate alternative data allows for the continuous refinement of trading models. By analyzing the outcomes of past trades, investors can identify areas for improvement and adjust their strategies accordingly (OptimizDBA). Data-Driven Insights: Leveraging alternative data for insights into market trends and consumer behavior can inform strategic adjustments to EMN strategies. This data-driven approach ensures that strategies remain relevant and effective in changing market environments (AlphaSense). Collaborative Innovation: Collaborating with data scientists and industry experts can foster innovation and enhance the development of EMN strategies. By sharing insights and expertise, investors can leverage the full potential of alternative data to drive superior performance (Aurum). Portfolio Construction and Risk Management in Equity Market Neutral Strategies Factor-Based Stock Selection

In equity market neutral (EMN) strategies, selecting the right stocks is crucial for achieving market neutrality and optimizing returns. Unlike traditional methods that rely heavily on historical price data, EMN strategies can benefit significantly from alternative data sources. These data sources include social media sentiment, satellite imagery, and web traffic analytics, which provide insights into market trends and company performance that are not captured by conventional financial metrics. For instance, social media sentiment analysis can reveal public perception and potential market movements before they are reflected in stock prices (CAIA).

Advanced Machine Learning Techniques

While LSTM models have been discussed in previous sections for stock prediction, this section focuses on other machine learning techniques that can enhance EMN strategies. Techniques such as random forests, gradient boosting machines, and support vector machines can be employed to capture complex, non-linear relationships in the data. These models can process large volumes of alternative data to identify patterns and predict stock movements more accurately. For example, random forests can be used to analyze a combination of financial ratios and alternative data to rank stocks based on their expected returns, thereby aiding in the construction of the long and short sides of the portfolio (Academia.edu).

Dynamic Portfolio Rebalancing

Dynamic portfolio rebalancing is a key component of risk management in EMN strategies. Unlike static rebalancing, which occurs at fixed intervals, dynamic rebalancing adjusts the portfolio in response to real-time market changes and new data inputs. This approach ensures that the portfolio remains aligned with the strategy’s objectives and market conditions. By integrating alternative data, such as real-time economic indicators and sentiment analysis, portfolio managers can make more informed decisions about when to rebalance the portfolio. This not only helps in maintaining market neutrality but also in capturing short-term market opportunities that may arise due to sudden shifts in market sentiment (MDPI).

Risk Metrics Beyond Traditional Measures

Traditional risk metrics like standard deviation and beta may not fully capture the risks associated with EMN strategies. Instead, advanced risk metrics such as Conditional Value-at-Risk (CVaR) and entropy pooling offer a more comprehensive view of potential risks. CVaR, for instance, measures the expected loss in the worst-case scenarios, providing a more robust assessment of tail risks. Entropy pooling, on the other hand, allows for the incorporation of subjective views and stress-testing scenarios, enabling a more nuanced risk management approach. These metrics help in identifying and mitigating risks that are not apparent through traditional measures, thereby enhancing the robustness of EMN strategies (Anton Vorobets).

Incorporating Sentiment Analysis

Sentiment analysis is an innovative tool for enhancing EMN strategies by providing insights into market psychology and investor behavior. By analyzing data from news articles, social media platforms, and financial reports, sentiment analysis can gauge the overall market mood and predict potential market movements. This information can be used to adjust the portfolio’s long and short positions to better align with market sentiment. For instance, a positive sentiment towards a particular sector may prompt an increase in long positions within that sector, while negative sentiment may lead to an increase in short positions. This proactive approach to portfolio management can improve the strategy’s performance and resilience in volatile markets (CAIA).

Integration of ESG Factors

Environmental, Social, and Governance (ESG) factors are increasingly being integrated into EMN strategies as a form of alternative data. ESG factors provide insights into a company’s sustainability practices and ethical considerations, which can influence long-term performance. By incorporating ESG data, EMN strategies can identify companies that are likely to outperform due to their strong ESG profiles. This not only enhances the strategy’s return potential but also aligns it with socially responsible investment practices. For example, companies with high ESG ratings may be favored for long positions, while those with poor ratings may be targeted for short positions, thereby aligning financial goals with ethical considerations (MDPI).

Continuous Monitoring and Adjustment

Continuous monitoring and adjustment are critical for maintaining the effectiveness of EMN strategies. This involves regularly reviewing the portfolio’s performance, risk exposures, and alignment with market conditions. By leveraging alternative data and advanced analytics, portfolio managers can identify emerging trends and potential risks in real-time. This enables them to make timely adjustments to the portfolio, such as reallocating assets or adjusting hedging strategies, to ensure that it remains on track to achieve its objectives. Continuous monitoring also facilitates the identification of underperforming assets, allowing for their timely replacement with better-performing alternatives (Academia.edu).

By integrating these advanced techniques and data sources, equity market neutral strategies can be significantly enhanced, providing better risk-adjusted returns and resilience in diverse market conditions. This approach not only leverages the latest advancements in data analytics and machine learning but also aligns with the growing demand for sustainable and responsible investment practices.

Conclusion

This research report outlines the construction of an Equity Market Neutral (EMN) strategy utilizing alternative data, emphasizing the integration of advanced machine learning models, sophisticated data collection techniques, and innovative risk management practices. The primary aim of EMN strategies is to exploit pricing inefficiencies while maintaining a neutral exposure to market movements. By leveraging alternative data sources such as social media sentiment, satellite imagery, and web traffic analytics, these strategies can enhance predictive accuracy and uncover alpha opportunities that traditional data might overlook. The report highlights the importance of data processing and signal generation, where techniques like Natural Language Processing (NLP) and geospatial analysis play crucial roles in extracting actionable insights from unstructured data.

The incorporation of machine learning models, particularly Long Short-Term Memory (LSTM) networks, is pivotal in handling time series data and predicting stock movements with high precision. These models, along with other techniques like ensemble learning and deep reinforcement learning, significantly improve the robustness and reliability of trading signals. Risk management is another critical component, with dynamic risk assessment and volatility prediction using alternative data providing a proactive approach to mitigating market risks. The report also underscores the benefits of integrating Environmental, Social, and Governance (ESG) factors, which align financial objectives with ethical investment practices, thereby enhancing the strategy’s appeal to socially responsible investors.

The findings suggest that the integration of alternative data and advanced analytics can significantly enhance the performance and resilience of EMN strategies, offering superior risk-adjusted returns even in volatile market conditions. The next steps involve continuous refinement of these strategies through feedback loops, data-driven insights, and collaborative innovation with data scientists and industry experts. By staying abreast of technological advancements and market trends, investors can ensure that their EMN strategies remain competitive and effective. This approach not only leverages cutting-edge data analytics but also aligns with the growing demand for sustainable and responsible investment practices, positioning EMN strategies as a valuable complement to traditional investment portfolios.

Conclusion: Fully automated generation (at least, this framework) does not seem yet on par with co-creation with a human expert, but a decent entrypoint for the layman.